CSGO Chronicles: Unfolding the Gaming Universe

Dive into the latest news, tips, and trends in the world of Counter-Strike: Global Offensive.

Why Paying Less for Insurance is Easier Than You Think

Discover simple strategies to slash your insurance costs without sacrificing coverage—start saving today!

10 Simple Strategies to Lower Your Insurance Premiums

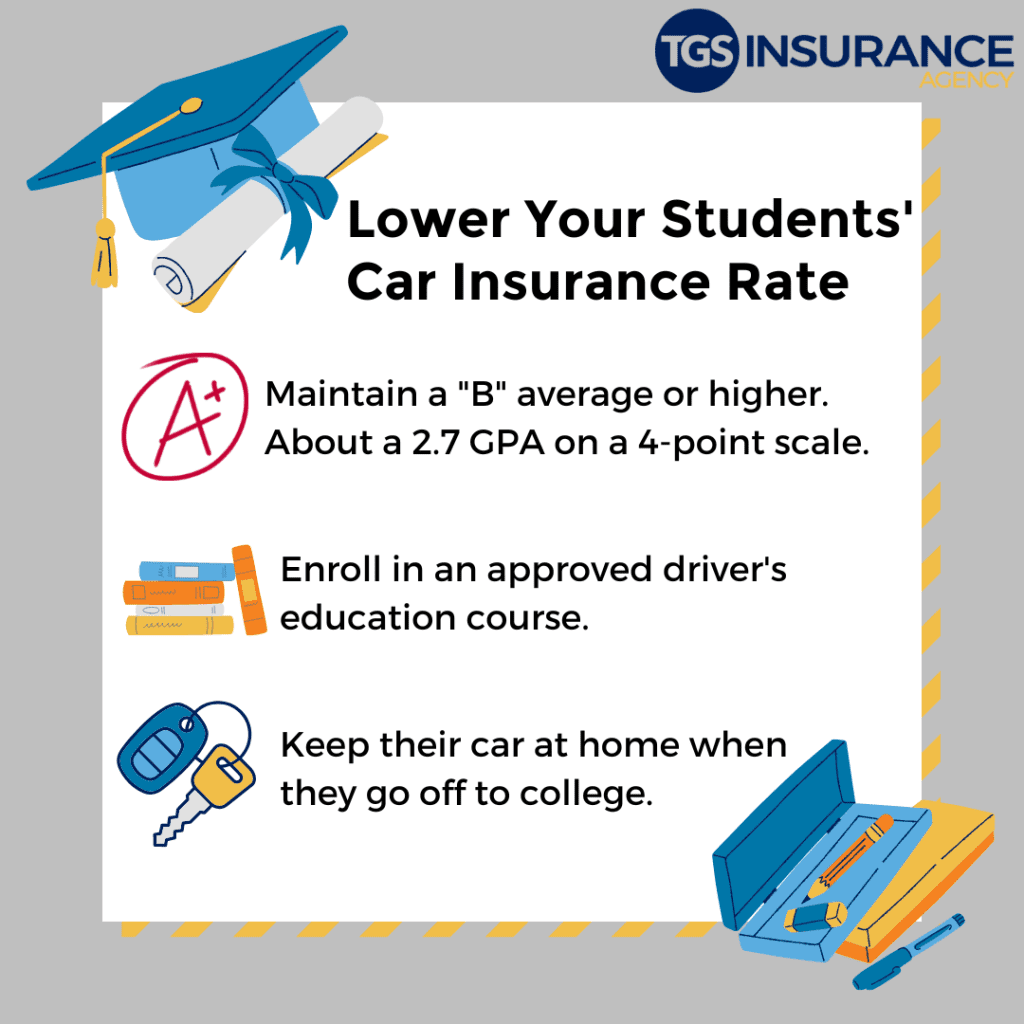

Lowering your insurance premiums can be easier than you think. By implementing these 10 simple strategies, you can significantly reduce your costs without sacrificing coverage. Consider bundling your policies by purchasing multiple types of insurance, such as home and auto, from the same provider. This often results in substantial discounts. Additionally, maintaining a good credit score can impact your premiums, so make sure to keep your credit in check. Another effective strategy is to increase your deductibles; while this means you’ll pay more out of pocket in the event of a claim, it can drastically lower your monthly payments.

Another way to lower your premiums is to regularly review and shop around for new insurance quotes. Rates change frequently, and a better deal might be just a click away. Don't forget to take advantage of discounts that many insurers offer, such as for safe driving records, military service, or being a long-time policyholder. Participating in a preventive maintenance program for your home or vehicle can also lead to lower rates, as it showcases your commitment to reducing risk. Finally, using technology like telematics devices can provide insurers with real-time data on your driving habits, potentially resulting in further discounts for safe driving behavior.

Debunking the Myths: Is Cheap Insurance Always Bad?

When it comes to cheap insurance, many people often fall victim to the common myth that lower premiums automatically mean lower quality coverage. However, this is not necessarily the case. Several insurance providers offer competitive rates while still providing adequate support and comprehensive policies. It’s important to understand that a cheap insurance plan can be a strategic choice if it aligns with your specific needs. For instance, younger drivers or those with a solid track record may find favorable rates without sacrificing essential coverage.

Furthermore, it's essential to consider what you truly need versus what you are being upsold. The notion that expensive insurance equates to better protection can be misleading. By shopping around and comparing policies, you can find cheap insurance that provides the coverage you need without unnecessary bells and whistles. Remember, the key is to read the fine print and understand the exclusions and terms of the policy. In the end, informed decisions rather than blind assumptions can help you navigate the world of insurance effectively.

How to Compare Insurance Quotes Effortlessly for the Best Deal

Comparing insurance quotes can seem daunting, but with the right approach, you can do it effortlessly and secure the best deal. Start by gathering multiple quotes from various insurers, and make sure to provide the same information to each provider. This ensures uniformity and allows for an apples-to-apples comparison. Keep track of the details in a spreadsheet or a comparison tool, noting the premiums, deductibles, and coverage options for each policy. This method not only saves time but also highlights disparities between offers.

Once you have your quotes organized, evaluate them based on your individual needs. Consider not just the premium costs but also the deductibles and policy limits. For example, if a policy has a lower premium but a high deductible, it may not be as beneficial in the long run. Read reviews and ratings of each insurer to assess their claim handling and customer service experiences. Remember, the cheapest option isn't always the best; aim for a balance of affordability and reliability to ensure you're making a wise investment in your protection.