CSGO Chronicles: Unfolding the Gaming Universe

Dive into the latest news, tips, and trends in the world of Counter-Strike: Global Offensive.

Why Paying Less for Auto Insurance is More Than Just Good Luck!

Unlock the secrets to saving big on auto insurance! Discover why paying less is more than just luck—start maximizing your savings now!

The Real Reasons Behind Low Auto Insurance Rates: More Than Just Luck

The landscape of auto insurance rates can often seem like a mystery, leading many to assume that low rates are simply a matter of luck or chance. However, the reality is far more nuanced. Insurance companies utilize a complex formula that includes numerous factors such as a driver's credit history, driving record, and even the make and model of the vehicle. For instance, individuals with a clean driving record and good credit may qualify for lower rates, as they are seen as less likely to file claims. Additionally, demographic factors such as age, gender, and location play a significant role in determining premiums, as insurers assess risk based on historical data and trends.

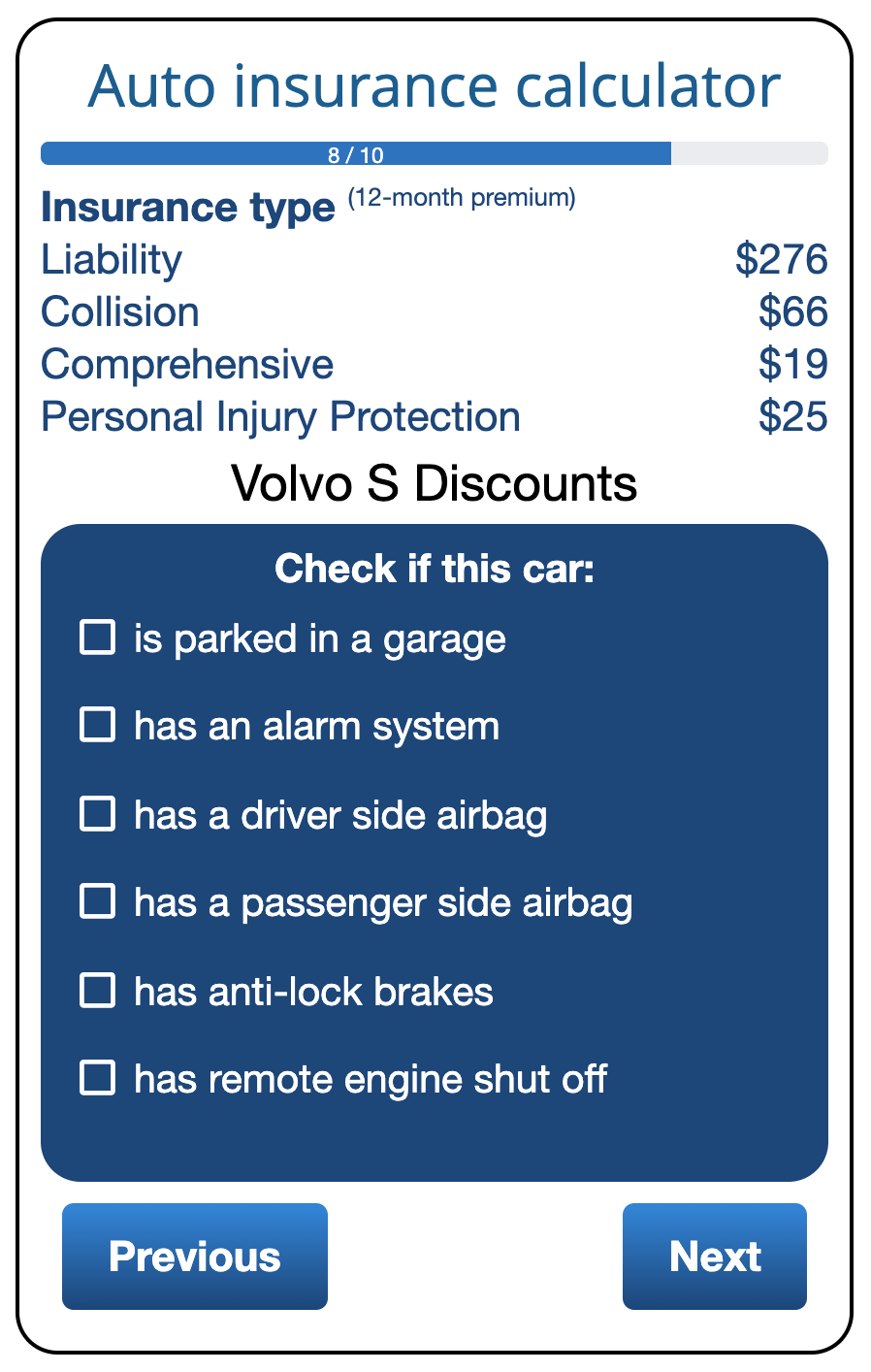

Another crucial element contributing to lower auto insurance rates is advancements in technology and data analytics. Insurers can now leverage sophisticated algorithms to analyze vast amounts of data that help predict and manage risk more effectively. For example, vehicles equipped with safety features like automatic braking or lane departure warnings are often assigned lower rates, as they reduce the likelihood of accidents. Furthermore, the rise of usage-based insurance models allows drivers to pay premiums based on their actual driving habits rather than generalized estimates, offering a path for responsible drivers to secure lower costs. Ultimately, understanding these underlying factors can empower consumers to make informed decisions and potentially save on their auto insurance premiums.

Unveiling the Secrets: How to Secure Affordable Auto Insurance

Finding affordable auto insurance can feel like a daunting task, especially with the myriad of options available in the market. However, by understanding a few key strategies, you can unveil the secrets to securing a policy that fits your budget. Start by shopping around and comparing quotes from multiple insurers. This will not only give you a sense of the average rates but also help you identify potential discounts you may be eligible for. Additionally, consider factors like your driving record, the type of vehicle you drive, and the coverage options you choose, all of which can significantly impact your premium.

Another valuable tip is to take advantage of discounts offered by insurance companies. Many insurers provide reductions for safe driving records, bundling multiple policies, or completing defensive driving courses. Furthermore, increasing your deductible can lower your monthly premium; however, make sure you're comfortable with the higher out-of-pocket expense in the event of an accident. By leveraging these strategies, you can effectively navigate the auto insurance landscape and find a policy that not only meets your needs but also fits your financial plan.

Is Cheaper Auto Insurance Just a Stroke of Luck? Here’s the Truth!

When searching for cheaper auto insurance, many consumers wonder whether their luck plays a significant role in finding those elusive deals. While it might seem that some drivers stumble upon incredible rates while others are left paying hefty premiums, the truth is that various factors contribute to the pricing of auto insurance. Rates can vary based on individual circumstances including driving history, credit score, location, and even the type of vehicle. Therefore, it’s crucial to approach the hunt for affordable auto insurance with a strategy rather than solely relying on fortuitous circumstances.

Another aspect to consider is the importance of comparison shopping and understanding policy details. Many people neglect to review their existing coverage, which can lead to overpaying for unnecessary features. By taking the time to compare quotes from different insurance providers and assessing each policy's terms, you can find significant savings. In conclusion, while it might feel like finding cheaper auto insurance is a stroke of luck, a more informed and proactive approach will surely lead to better outcomes.