CSGO Chronicles: Unfolding the Gaming Universe

Dive into the latest news, tips, and trends in the world of Counter-Strike: Global Offensive.

Whole Life Insurance: A Policy Worth Living For

Discover why Whole Life Insurance is more than just a policy—it's a lifelong investment in security and peace of mind!

Understanding Whole Life Insurance: Benefits and Features Explained

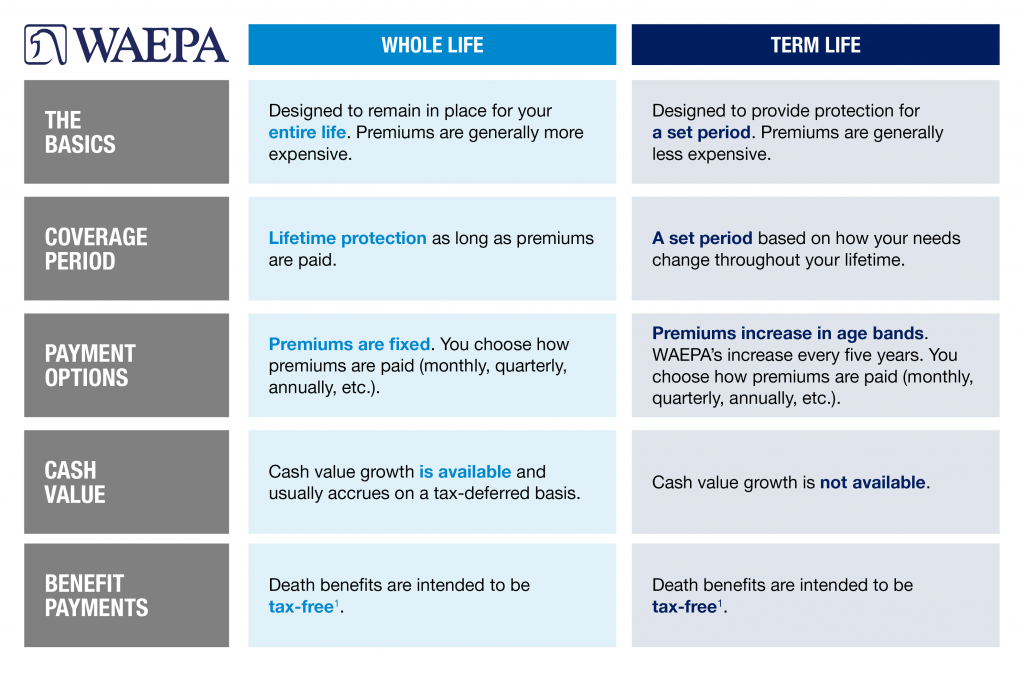

Whole life insurance is a type of permanent life insurance that offers a unique blend of protection and savings. Unlike term life insurance, which provides coverage for a specific period, whole life insurance ensures lifelong coverage as long as premiums are paid. One of the most significant benefits of this insurance type is the cash value component, which accumulates over time. This cash value can be accessed through policy loans or withdrawals, giving policyholders financial flexibility in times of need. Additionally, the policy's death benefit is guaranteed, making it a reliable option for those looking to provide financial security for their loved ones.

Some key features of whole life insurance include a guaranteed death benefit, fixed premiums, and the potential for dividends, depending on the insurer's performance. Whole life policies typically have fixed premium rates that remain unchanged throughout the policy's life. This stability allows policyholders to budget effectively for their insurance needs. Moreover, many whole life policies participate in profits generated by the insurance company, which can lead to annual dividends. These dividends can be reinvested to increase cash value or used to offset premium payments, making whole life insurance an attractive long-term investment strategy.

Is Whole Life Insurance Right for You? Common Questions Answered

When considering whether whole life insurance is right for you, it's essential to understand what it entails. Unlike term life insurance, which provides coverage for a specified period, whole life insurance offers lifelong protection and includes a savings component known as cash value. This feature allows your policy to accumulate value over time, which can be borrowed against or withdrawn. Here are some common questions to help guide your decision:

- How does the cash value grow?

- What are the premium costs compared to term insurance?

- How flexible is the policy in terms of payments and benefits?

Another vital aspect to consider is your individual financial situation and long-term goals. While whole life insurance can be an excellent investment for some, it may not be suitable for everyone. For example, if you are looking for an affordable way to provide a death benefit for your loved ones, term insurance might be a better choice. Conversely, if you seek a guarantee of lifelong coverage and an investment vehicle, whole life insurance could be ideal. Ultimately, carefully evaluate your needs and consult with a financial advisor to make an informed choice.

How to Choose the Best Whole Life Insurance Policy for Your Needs

Choosing the best whole life insurance policy for your needs requires a thorough understanding of your financial goals and family situation. Start by evaluating your long-term objectives—are you looking for coverage to provide for your family, pay off debts, or accumulate cash value over time? Consider factors such as your age, health status, and budget when narrowing down your options. Additionally, it's essential to compare policies from various insurers, focusing on the premium rates, death benefits, and any potential dividends that may be available.

Next, delve into the specific features of the policies you're considering. Look for options that allow flexibility in premium payments and the potential for policy loans against the cash value. An important aspect of selecting the best whole life insurance policy is understanding the company's financial strength and customer service track record. Reading reviews and consulting with a licensed insurance agent can provide valuable insights. Finally, take your time to weigh the advantages and disadvantages of each policy, ensuring that your selected plan aligns with your overall financial strategy.