CSGO Chronicles: Unfolding the Gaming Universe

Dive into the latest news, tips, and trends in the world of Counter-Strike: Global Offensive.

When Fido Gets Sick: Why Pet Insurance Might Just Save the Day

Discover how pet insurance can be a lifesaver for your furry friend when illness strikes. Don't wait—secure their health today!

Understanding the Benefits of Pet Insurance: Is It Worth the Investment?

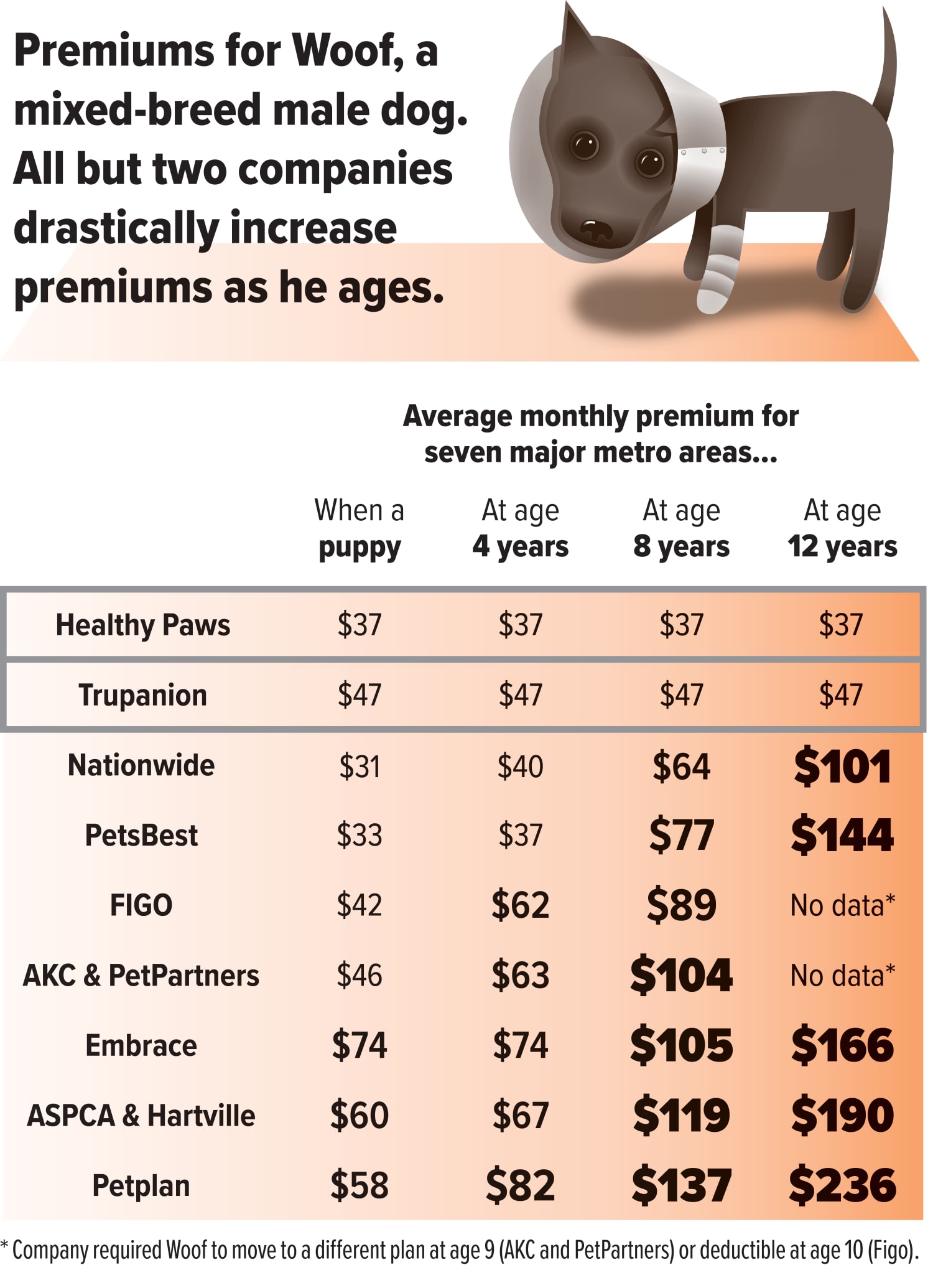

Understanding the benefits of pet insurance is crucial for pet owners looking to safeguard their furry friends' health while also managing their finances. Pet insurance can cover a variety of services, including routine check-ups, surgical procedures, and emergency care. By investing in a policy, pet owners can avoid the financial strain that can arise from unexpected veterinary expenses, which can often reach thousands of dollars. Furthermore, many pet insurance providers offer customizable plans, allowing owners to choose coverage levels that suit their needs and budgets.

Is pet insurance worth the investment? Many experts believe it is, especially when considering the rising costs of veterinary care, as highlighted by recent studies showing that pet healthcare costs have increased significantly over the past decade. Additionally, having insurance can provide peace of mind, knowing that financial limitations won't dictate necessary medical care for your pet. In conclusion, while the initial cost of pet insurance can seem daunting, the long-term benefits and protection it offers can far outweigh the investment, making it a wise consideration for responsible pet ownership.

Top 5 Reasons Pet Owners Should Consider Insurance for Their Furry Friends

As a pet owner, providing the best care for your furry friend is undoubtedly your top priority. One essential aspect that often gets overlooked is pet insurance. Here are the top 5 reasons why you should strongly consider adding it to your pet care plan:

- Financial Protection: With the rising costs of veterinary care, pet insurance can save you from unexpected expenses. According to the American Animal Hospital Association, treatments can range from a few hundred dollars to several thousand, depending on the condition.

- Access to Quality Care: Insurance allows you to seek the best medical treatment for your pet without the constant worry of costs. Whether it's a routine check-up or an emergency procedure, having insurance means you won’t have to compromise on your pet's health due to financial constraints.

- Peace of Mind: Knowing that you have a safety net in case of medical emergencies significantly reduces stress for pet owners. You can focus on providing your furry friend with love and comfort, rather than stressing over potential bills!

- Comprehensive Coverage Options: Many pet insurance plans offer a range of coverage options, from accident-only policies to comprehensive plans that cover illnesses, routine check-ups, and even behavioral therapy. Research your options thoroughly; sites like Pet Insurance Review can provide valuable insights.

- Improved Health Monitoring: Regular vet visits become more feasible with insurance, allowing for consistent health monitoring and preventative care, which can lead to early detection of health issues, ultimately saving you both money and heartache.

What to Do When Your Pet Falls Ill: How Insurance Can Help You Navigate the Costs

When your beloved pet falls ill, it can be both distressing and financially burdensome. The cost of veterinary care can add up quickly, leading many pet owners to wonder how they will manage the expenses. Pet insurance can be a lifesaver in these situations, providing coverage for unexpected medical emergencies. It’s essential to understand the different plans available. Some policies cover only accidents and emergencies, while others include routine care and preventive treatments. For more information about various pet insurance plans, check out the resources from the American Kennel Club.

In addition to mitigating costs, having pet insurance can give you peace of mind during emotional times. When faced with tough decisions about your pet's health, knowing that financial considerations won’t limit your options can be a relief. Before your pet becomes ill, it’s wise to research different insurers to find the best policy for your needs. Remember to read all the fine print regarding exclusions and waiting periods. If you want to see how insurance can make a difference in real-life scenarios, consider checking out this blog post that illustrates various ways pet insurance has helped other pet owners.