CSGO Chronicles: Unfolding the Gaming Universe

Dive into the latest news, tips, and trends in the world of Counter-Strike: Global Offensive.

Term Life Insurance: Because Life's Unpredictable

Secure your family's future with term life insurance. Discover how to protect what matters most in an unpredictable world!

Understanding Term Life Insurance: Key Benefits and Features

Term life insurance is a type of life insurance policy that provides coverage for a specified period, typically ranging from 10 to 30 years. One of the key benefits of term life insurance is its affordability. Premiums are generally lower than those of whole life policies, making it an attractive option for individuals seeking financial protection on a budget. Additionally, term life insurance offers a straightforward approach to coverage, allowing policyholders to focus on safeguarding their loved ones during critical years, especially if they have dependents or outstanding debts.

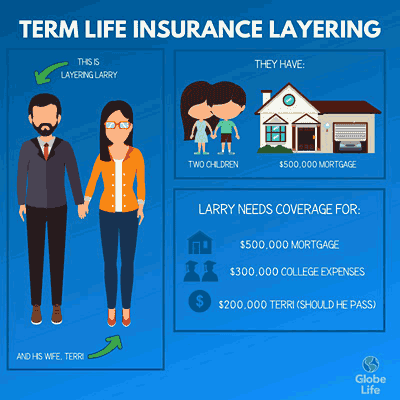

Another significant feature of term life insurance is its flexibility. Policyholders can often choose the duration of the coverage to align with their financial goals, such as paying off a mortgage or funding their children's education. Furthermore, many policies offer renewable options, allowing individuals to extend their coverage after the initial term expires without having to undergo a medical exam. In summary, understanding the benefits and features of term life insurance can empower individuals to make informed decisions about their financial planning and ensure peace of mind for their family’s future.

Is Term Life Insurance Right for You? 5 Questions to Consider

When considering whether term life insurance is right for you, it's crucial to evaluate your individual circumstances and financial goals. This type of insurance provides coverage for a specified period, typically ranging from 10 to 30 years. To determine if it's a suitable option, ask yourself the following questions:

- Do you have dependents who rely on your income?

- What are your long-term financial obligations?

- Can you afford the premiums?

- Are you in good health?

- What is your age and overall life expectancy?

Each of these questions plays a significant role in your decision-making process regarding term life insurance. For instance, if you have young children or significant debts, securing a policy might provide peace of mind knowing your loved ones are protected financially in the event of your untimely passing. Conversely, if you find yourself with no financial dependents and sufficient savings, you might reconsider whether investing in a term policy is necessary. Make sure to weigh your options carefully and consult a financial advisor if needed.

How to Choose the Best Term Life Insurance Policy for Your Needs

Choosing the best term life insurance policy for your needs involves a careful assessment of several key factors. First, evaluate your financial situation and determine how much coverage you require. This can depend on various aspects such as your current debts, future obligations like your children's education, and the financial security you wish to provide for your beneficiaries. It’s advisable to calculate a coverage amount that can comfortably meet these needs while also considering any potential lifestyle changes that may occur during the term.

Next, it's crucial to compare different policies from various providers. Look for features such as convertibility options, which allow you to convert your term policy to a permanent one later on if your needs change. Additionally, consider the length of the term that suits you best, whether it's 10, 20, or 30 years. Don't forget to read reviews and get quotes to find a policy that fits both your budget and coverage requirements, ensuring that you make an informed decision that supports your long-term financial goals.