CSGO Chronicles: Unfolding the Gaming Universe

Dive into the latest news, tips, and trends in the world of Counter-Strike: Global Offensive.

Quotes That Save: The Surprising Benefits of Comparing Insurance Rates

Discover how comparing insurance rates can save you cash and stress—uncover the surprising benefits you didn’t know existed!

Why You Should Always Compare Insurance Rates: Hidden Benefits Revealed

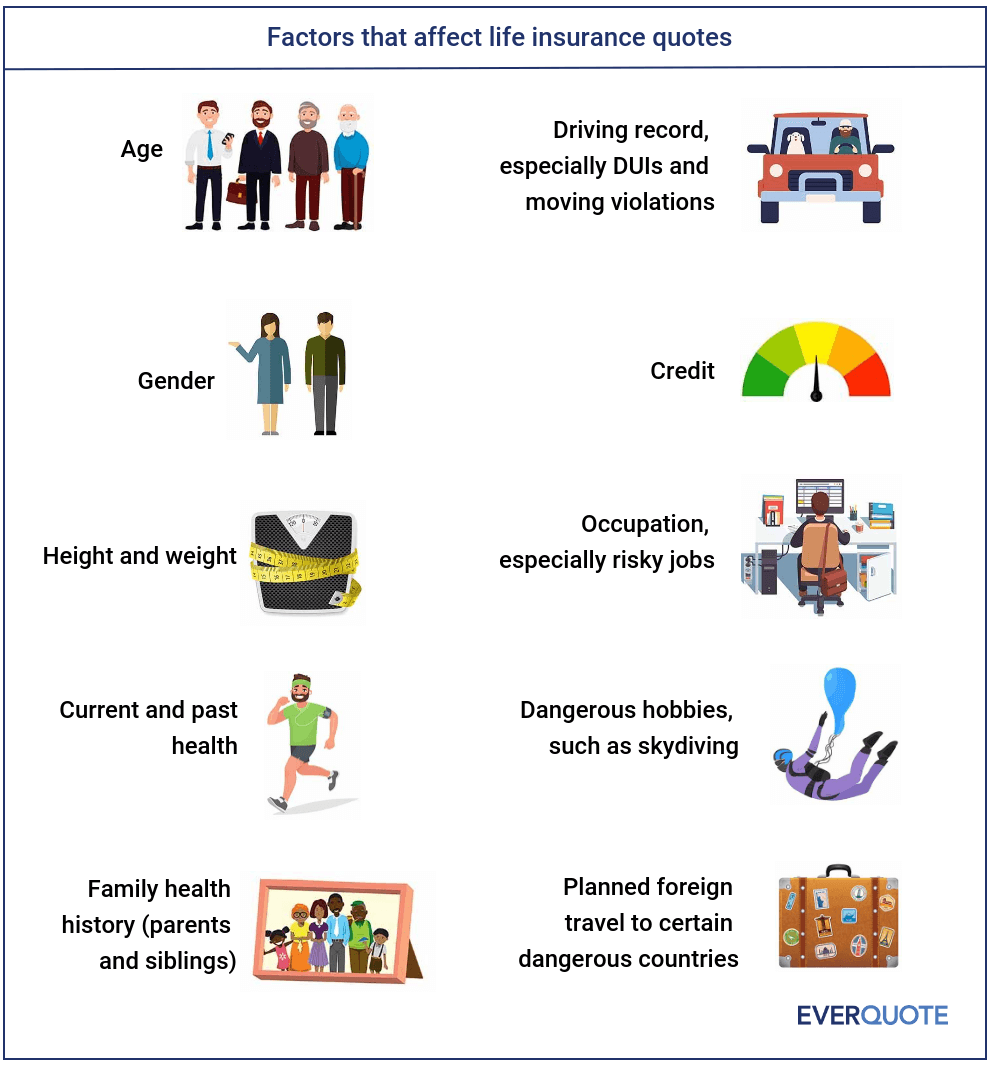

When it comes to managing your finances, comparing insurance rates is one of the smartest decisions you can make. Often, consumers calculate their insurance costs without considering various options, leading to potentially higher premiums. By taking the time to compare insurance rates from different providers, you can not only save money but also uncover various policy features that may suit your needs better. For example, some insurers offer discounts for bundling policies, maintaining a good credit score, or having a clean driving record. This diligence can lead to significant savings over time.

Moreover, comparing insurance rates can reveal hidden benefits that you might not initially consider. For instance, while one insurer may offer a lower premium, their customer service ratings could be subpar, leading to stress when you need to file a claim. In contrast, another option could provide a slightly higher rate but come with superior customer support and faster claim processing. Therefore, thorough research allows you to avoid potential pitfalls and choose a policy that not only meets your budget but also aligns with your expectations of service quality.

5 Surprising Ways Shopping for Insurance Can Save You Money

Shopping for insurance might seem like a mundane chore, but it can actually lead to significant savings! One of the surprising ways to save money is by comparing quotes from multiple providers. By doing this, you can uncover hidden discounts and find better rates that suit your specific needs. Bundling policies is another effective strategy to reduce costs; many companies offer generous discounts if you purchase multiple types of insurance, such as home and auto, together. Take the time to explore different options and clarify what each provider has to offer.

Furthermore, being proactive about your coverage can lead to savings! Consider adjusting your deductibles. A higher deductible often results in lower premium payments, allowing you to save in the long run if you rarely make claims. Additionally, maintaining a good credit score can affect your insurance rates. Insurers often factor in your credit history, meaning that improving your credit can not only benefit you financially in other areas but can also lead to lower premiums. By employing these surprising strategies, you can effectively reduce your insurance expenditures.

How Comparing Insurance Rates Can Lead to Better Coverage: A Complete Guide

When searching for the best insurance coverage, comparing rates is an essential step that can significantly impact your financial security and peace of mind. By comparing insurance rates, you not only get a clearer picture of what different providers offer, but you also identify gaps in coverage and potential savings. Use online tools or services that provide side-by-side comparisons of policies, which can help you analyze important factors, such as deductibles, coverage limits, and premium costs. This comprehensive approach ensures that you select a policy that both fits your budget and meets your specific needs.

Moreover, it’s crucial to understand that the lowest rate doesn’t always equate to the best coverage. Often, providers offer lower premiums by skimping on essential services or limitations in their policies. To avoid this pitfall, create a list of minimum coverage requirements tailored to your situation. For instance, if you're a homeowner, compare multi-policy discounts that bundle homeowners and auto insurance to maximize coverage while reducing costs. Ultimately, the time you invest in comparing insurance rates not only helps you save money but also leads to better, more comprehensive coverage tailored to protect your assets.