CSGO Chronicles: Unfolding the Gaming Universe

Dive into the latest news, tips, and trends in the world of Counter-Strike: Global Offensive.

Quote Quest: Finding the Hidden Gems of Insurance Savings

Unlock secret savings on insurance! Join our Quote Quest and discover hidden gems that could save you hundreds. Don't miss out!

Unlocking the Secrets: How to Find Hidden Insurance Discounts

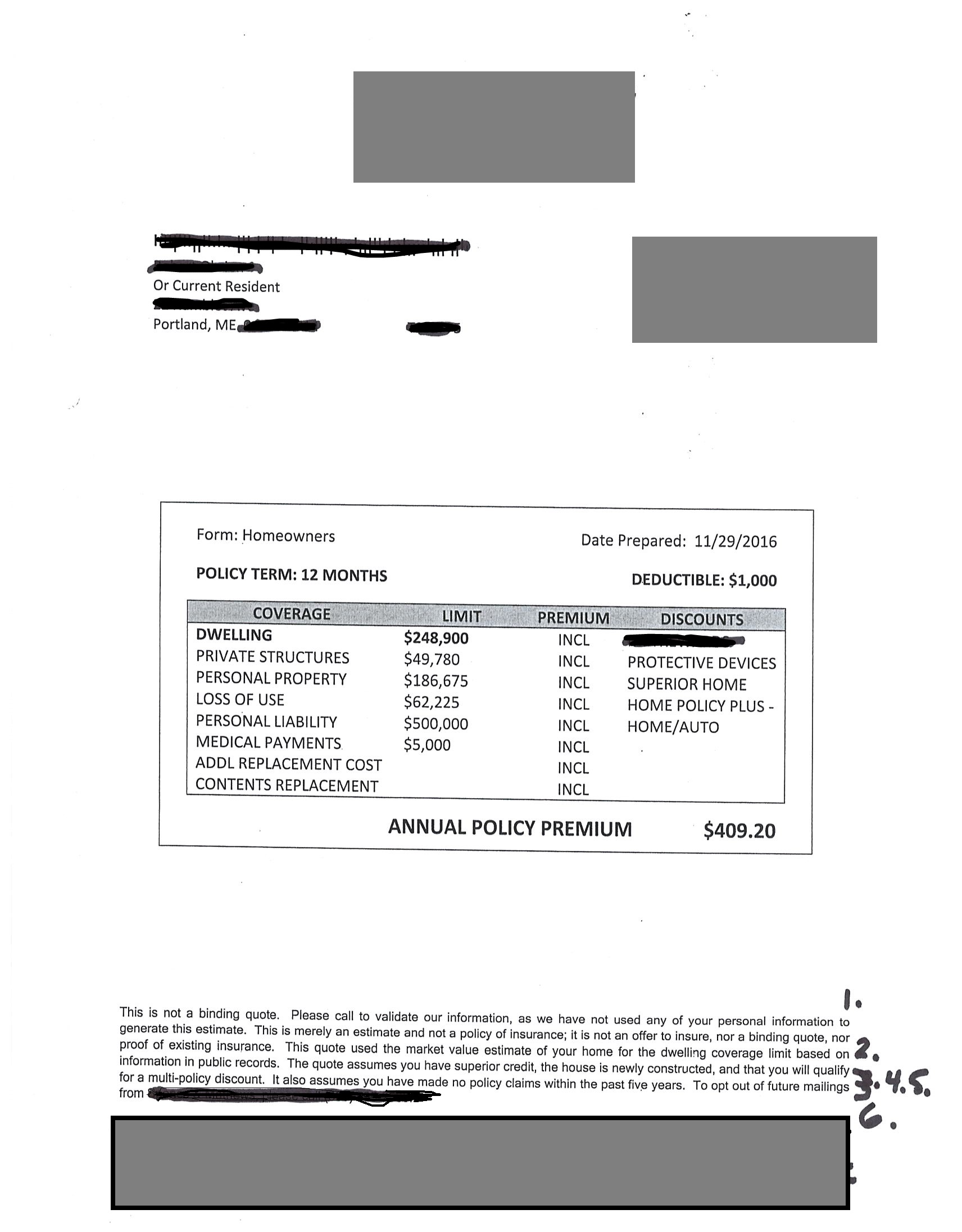

Finding hidden insurance discounts can significantly lower your premiums, making it essential to explore all available options. Start by reviewing your current policy and asking your insurer about any undisclosed discounts. Many companies offer multi-policy discounts for bundling services such as auto and home insurance. Additionally, inquire about loyalty discounts that reward long-term customers and good driver discounts for maintaining a clean driving record. Don’t hesitate to ask specific questions, as many discounts are not prominently advertised.

Another effective strategy is to leverage your affiliations and membership in organizations that may provide access to exclusive discounts. For example, certain employers, alumni associations, or even professional organizations may negotiate special rates with insurance companies. It's also worth considering discounts for safety features in your home or vehicle, such as security systems or advanced driving aids. By proactively hunting for these hidden savings, you can unlock valuable insurance discounts that can lead to significant financial relief over time.

The Ultimate Guide to Comparing Insurance Quotes: Tips for Maximum Savings

When it comes to finding the best insurance policy, comparing insurance quotes is crucial for maximizing your savings. Start by collecting quotes from multiple providers to ensure you have a comprehensive view of the options available to you. Use online comparison tools to simplify this process and make sure to review detailed coverage options. Remember that the cheapest option is not always the best; look for a balance between price and coverage. Here are a few tips to keep in mind:

- Assess your coverage needs before diving into quotes.

- Check the insurer's reputation for customer service and claims handling.

- Don’t hesitate to ask for discounts—they may not always be advertised.

Once you've gathered your quotes, take a moment to compare them side by side. Look beyond the premium amounts—examine the deductibles, coverage limits, and any exclusions or special conditions. Organizing this information in a table can help you see the differences more clearly. Additionally, consider reaching out to your current insurer to see if they can match or beat the quotes you've received. Bundling insurance policies, such as home and auto, often leads to additional savings. By following these strategies, you can feel confident that you are making an informed decision that maximizes your savings when it comes to comparing insurance quotes.

Are You Paying Too Much for Insurance? Discover Hidden Savings Opportunities

When it comes to managing your finances, insurance can often feel like a necessary burden. Many households are unknowingly overpaying for their coverage, which can lead to significant financial strain over time. By taking the time to evaluate your current policies and shopping around for better rates, you might uncover hidden savings opportunities that could save you hundreds, if not thousands, of dollars annually. Here are a few steps to consider:

- Review your current policies and coverage levels.

- Compare quotes from multiple providers.

- Ask about discounts for bundling policies.

In addition to comparing different insurance companies, it is essential to understand the factors that influence your premiums. For instance, your credit score, claims history, and even your location can greatly affect the cost of coverage. Taking proactive steps to improve your credit score or increase your deductible can also lead to lower premiums. Remember, insurance companies appreciate customers who represent a reduced risk. By staying informed and vigilant, you can make smarter choices and ensure you are not paying too much for insurance.