CSGO Chronicles: Unfolding the Gaming Universe

Dive into the latest news, tips, and trends in the world of Counter-Strike: Global Offensive.

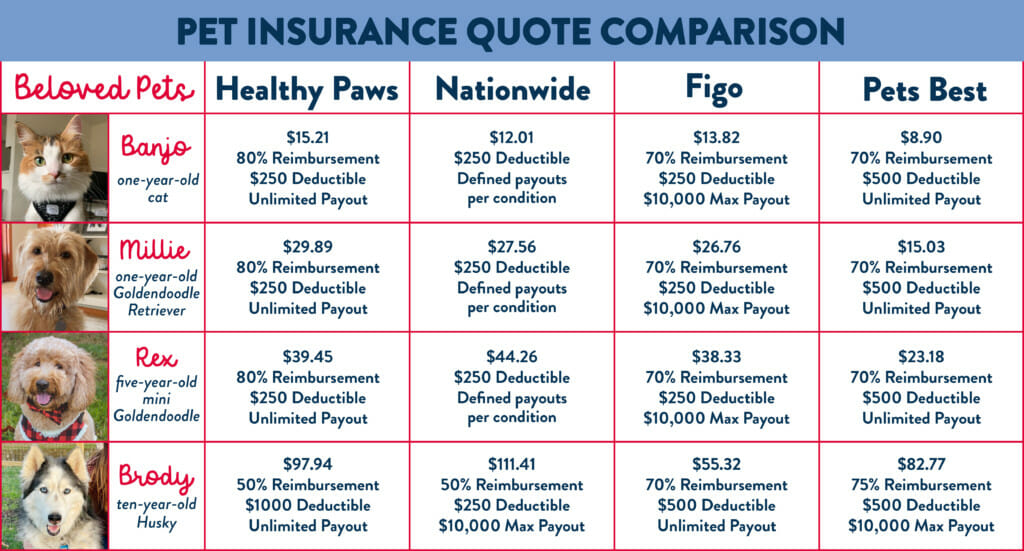

Paws and Dollars: Is Pet Insurance Worth the Bark?

Discover if pet insurance is a wise investment for your furry friend! Uncover the truth behind costs and coverage options now!

Understanding Pet Insurance: Is It a Good Investment for Your Furry Friend?

Understanding pet insurance is essential for any pet owner considering the well-being of their furry friend. With the rising costs of veterinary care, many pet owners are left wondering whether investing in a policy is worthwhile. Pet insurance can help cover unexpected medical expenses, giving you peace of mind while ensuring your pet receives the necessary treatments. However, before making a decision, it's crucial to evaluate the various plans available and take into account factors such as your pet's age, breed, and any pre-existing conditions.

One of the primary benefits of pet insurance is the financial protection it offers during emergencies or unforeseen illnesses. With an average pet owner spending upwards of $500 per year on veterinary care, having a policy can significantly reduce out-of-pocket expenses. To determine if it's a good investment, consider these points:

- The average lifetime cost of pet ownership.

- Potential savings versus monthly premiums.

- Your ability to pay for unexpected bills without insurance.

Top 5 Reasons to Consider Pet Insurance for Your Canine and Feline Companions

As responsible pet owners, ensuring the health and well-being of our canine and feline companions is a top priority. Here are the top 5 reasons to consider pet insurance for your pets:

- Financial Protection: Unexpected veterinary costs can add up quickly. Pet insurance can help you manage these expenses, allowing you to provide the best care for your furry friends without breaking the bank.

- Access to Quality Care: With pet insurance, you can access a wider range of veterinary services and treatments, ensuring your pets receive the best possible care, even in emergencies.

Continuing with our list,

- Peace of Mind: Knowing that your pet is covered can alleviate stress during health emergencies. You can focus on their well-being rather than worrying about costs.

- Preventive Care: Many insurance plans offer coverage for routine check-ups and vaccinations, promoting proactive health management for your pets.

- Customizable Coverage: Pet insurance plans often allow you to tailor coverage to fit your needs, ensuring you have the right protection for your unique situation.

Pet Insurance Myths Debunked: What Every Pet Owner Should Know

As a pet owner, understanding the truth about pet insurance can save you from costly surprises down the line. One prevalent myth is that pet insurance is only necessary for older pets or those with pre-existing conditions. In reality, enrolling your young and healthy pet in a policy early on can lead to significant savings over time. Insurers often offer lower premiums to younger pets and are more likely to provide coverage for unexpected illnesses that may develop later in life. Therefore, debunking this myth is crucial for any pet owner looking to safeguard their furry companions.

Another common misconception is that pet insurance covers everything and is completely foolproof. While many policies do offer comprehensive coverage, they typically have exclusions, waiting periods, and maximum payout limits. It's essential to read the fine print and understand what is covered and what isn't. Pet owners should also be aware that some policies don't cover routine care like vaccinations and check-ups, which leaves a gap that could lead to unexpected expenses. Being informed about these limitations will empower pet owners to choose the right policy that aligns with their needs.