CSGO Chronicles: Unfolding the Gaming Universe

Dive into the latest news, tips, and trends in the world of Counter-Strike: Global Offensive.

Insuring Your Passion: Protecting Small Biz Dreams

Protect your passion and secure your small biz dreams! Discover essential insurance tips to thrive and succeed.

Understanding Insurance Needs for Your Small Business: A Comprehensive Guide

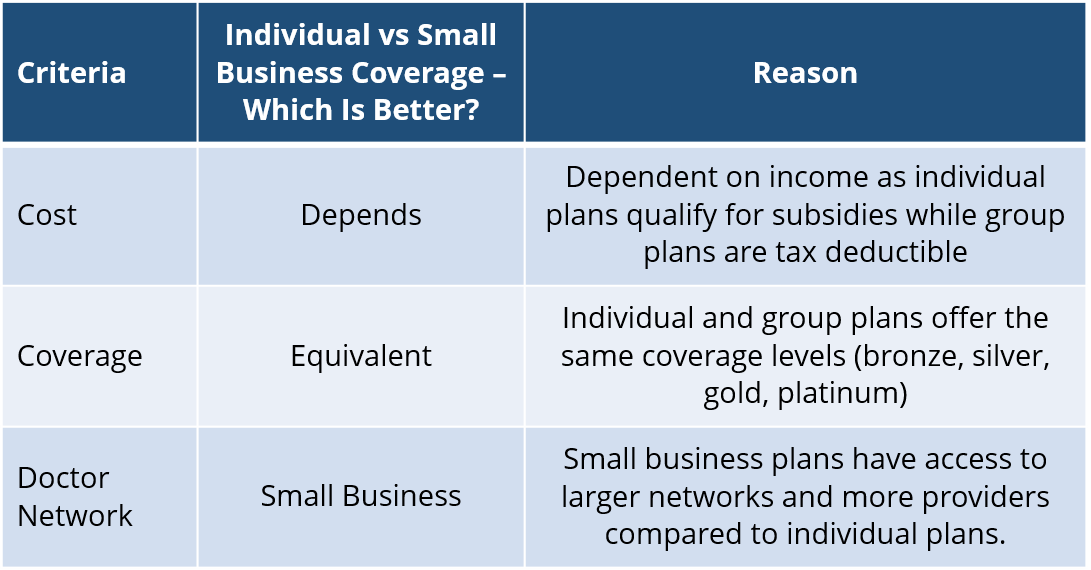

Understanding insurance needs for your small business is crucial for protecting your assets and ensuring long-term sustainability. Every entrepreneur must evaluate the specific risks their business faces and tailor their insurance coverage accordingly. Common types of insurance policies that small businesses should consider include general liability, property insurance, and professional liability. It’s essential to conduct a thorough assessment of your business operations to identify unique risks, and consult with an experienced insurance agent who can help guide you through the various options available.

Additionally, it's important to remember that insurance needs may change as your business grows. You should regularly review your policies to ensure they adequately cover new risks or changes in operations. For instance, if you hire more employees, you may need to consider adding workers' compensation insurance. Establishing a comprehensive risk management plan can also aid in understanding your coverage requirements. Always prioritize insurance as a proactive measure rather than a reactive one, to safeguard against potential financial setbacks.

Top 5 Insurance Policies Every Small Business Owner Should Consider

As a small business owner, safeguarding your enterprise is crucial for long-term success. One of the most effective ways to do this is by investing in the right insurance policies. Here are the Top 5 Insurance Policies Every Small Business Owner Should Consider:

- General Liability Insurance: This foundational policy protects your business from claims of bodily injury, property damage, and personal injury. Whether you're meeting with clients off-site or hosting events, having this coverage can save you from significant financial losses.

- Property Insurance: If you own or lease a physical location, property insurance covers the costs of repairing or replacing your business assets in the event of damage or theft.

- Business Interruption Insurance: In case of unforeseen circumstances that halt your operations, this policy provides compensation for lost income and helps with ongoing expenses.

- Professional Liability Insurance: Also known as errors and omissions insurance, this policy protects you against claims of negligence related to your services, making it essential for service-based businesses.

- Workers’ Compensation Insurance: This policy is vital if you have employees; it covers medical expenses and lost wages for employees who become injured or ill while working.

How to Protect Your Passion: Common Insurance Questions Answered

When it comes to protecting your passion, understanding the right insurance coverage is crucial. Many individuals question what types of insurance are necessary to safeguard their hobbies or freelance careers. Common queries often include, 'Do I need liability insurance for my craft business?' or 'What does a homeowner's policy cover regarding my equipment?' To address these concerns, it’s essential to recognize that the nature of your passion dictates the type of insurance you might require. For instance, if you’re a photographer, specific equipment insurance can protect against damages, while liability coverage can protect against potential lawsuits.

Another frequent question is, 'How can I ensure I'm adequately covered?' One effective way to achieve this is by conducting a thorough audit of your assets and consulting with an insurance agent who understands your field. Protecting your passion goes beyond basic coverage; it involves evaluating risks and understanding policy details. Consider creating a list of questions to address with your agent, such as:

- What types of incidents are covered?

- Are there any exclusions I should be aware of?

- How does the claims process work?