CSGO Chronicles: Unfolding the Gaming Universe

Dive into the latest news, tips, and trends in the world of Counter-Strike: Global Offensive.

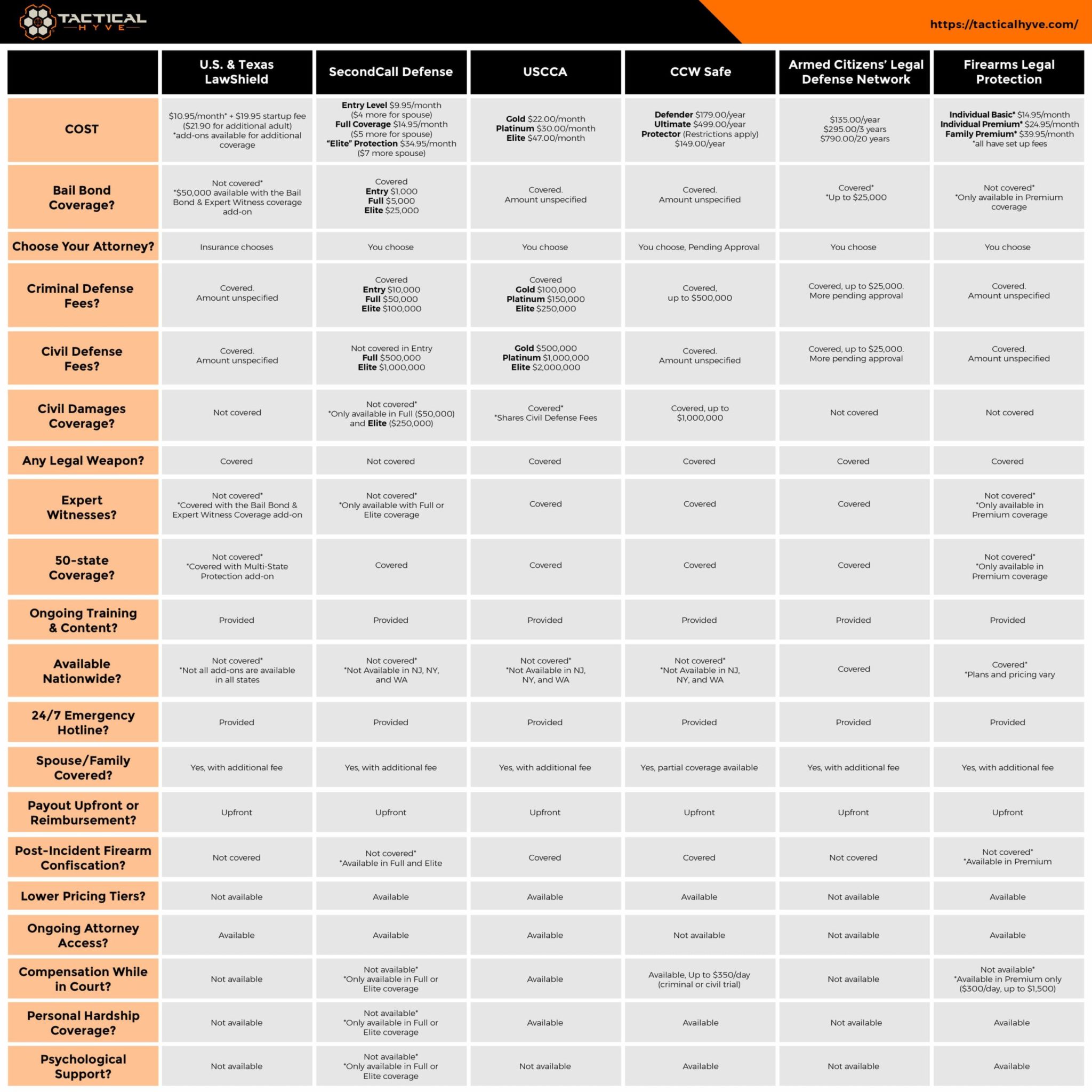

Insurance Showdown: The Matchup You Didn't Know You Needed

Discover the ultimate insurance face-off! Uncover surprising insights and what coverage truly fits your needs in this thrilling showdown!

Understanding the Differences: Health Insurance vs. Life Insurance

Health insurance and life insurance are two essential types of coverage that serve different purposes in financial planning. Health insurance provides coverage for medical expenses, ensuring that individuals can access necessary healthcare services without incurring excessive out-of-pocket costs. This type of insurance typically includes a range of services such as hospitalization, doctor visits, prescription medications, and preventive care. In contrast, life insurance is designed to offer financial protection to beneficiaries in the event of the policyholder's death. It serves as a safety net, providing a lump sum payment that can cover expenses like mortgage payments, education costs, or daily living expenses for loved ones.

Understanding the key differences between these two coverage types is crucial for effective financial planning. While health insurance focuses on covering medical costs throughout one’s life, life insurance provides a financial payout after death, catering more to the long-term financial security of loved ones. To summarize the differences:

- Health Insurance: Covers healthcare costs and medical services.

- Life Insurance: Provides a payout to beneficiaries upon the policyholder's death.

By recognizing these distinctions, individuals can make informed decisions regarding their insurance needs.

Which Is Right for You? A Comprehensive Guide to Auto vs. Home Insurance

Choosing between auto insurance and home insurance can be a daunting task, especially if you're not familiar with the intricacies of each type of coverage. Both types of insurance serve crucial roles in protecting your assets, but they cater to different needs. Auto insurance primarily covers vehicles against damages from accidents, theft, or natural disasters, while home insurance provides protection for your property and belongings in case of fire, theft, or other hazards. To determine which is right for you, consider factors such as your living situation, financial obligations, and local weather conditions.

To help you navigate the decision-making process, here are some key points to consider:

- Cost: Compare premiums for both insurance types to see which fits your budget.

- Coverage needs: Assess what you require coverage for based on your property and vehicle.

- Legal requirements: Ensure you understand the laws in your area, as auto insurance is often mandatory while home insurance is not.

Taking the time to evaluate these factors will empower you to choose the insurance that best aligns with your needs, ensuring that your most valuable assets are adequately protected.

The Ultimate Insurance Face-Off: Standard vs. Specialty Policies Explained

When it comes to protecting your assets and finances, understanding the difference between standard and specialty insurance policies is crucial. Standard policies are designed to cover common risks, such as homeowners or auto insurance, and typically offer a broad range of coverage for everyday events. These policies are often more affordable and widely accessible, making them suitable for most individuals and families looking for basic protection. On the other hand, specialty policies cater to unique needs and higher-risk situations, such as collectible car insurance or pet liability coverage. They provide tailored solutions for specific assets or activities that might not be adequately covered by standard options.

Choosing the right type of policy depends on your individual circumstances and the level of risk you are willing to accept. Here are some key considerations when deciding between standard and specialty insurance policies:

- Assess Your Needs: Evaluate the specific assets or risks you need coverage for and whether standard options suffice.

- Cost Implications: Consider the premiums associated with each type of policy and your budget for insurance.

- Coverage Scope: Understand the limits and exclusions within standard policies compared to the more customized offerings of specialty policies.