CSGO Chronicles: Unfolding the Gaming Universe

Dive into the latest news, tips, and trends in the world of Counter-Strike: Global Offensive.

Home Insurance Secrets Your Agent Probably Won't Share

Unlock the hidden truths of home insurance and learn secrets your agent won’t share! Don’t miss out on saving money and coverage tips!

5 Hidden Home Insurance Coverage Options You Need to Know

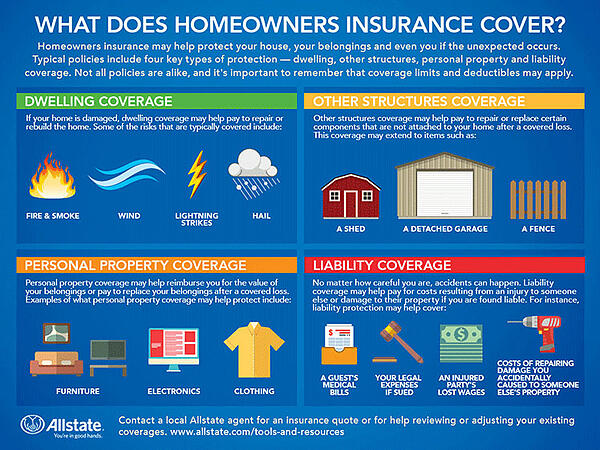

When it comes to protecting your home, many homeowners are unaware of the hidden home insurance coverage options available to them. These options can provide additional peace of mind by covering situations that standard policies might overlook. For instance, identity theft protection can be a valuable addition to your home insurance, as it helps cover expenses related to restoring your identity if it is compromised. Similarly, personal property replacement cost coverage ensures that you receive the full value of your belongings, rather than the depreciated value, in the event of a loss.

Another often-overlooked option is equipment breakdown coverage, which can help you repair or replace essential home systems like heating and cooling units, or even major appliances, without bearing the full financial burden yourself. Furthermore, if you have a home-based business, you might want to explore business property coverage that extends your insurance policy to include business-related equipment and inventory. Lastly, some policies offer water backup coverage, which protects against damage caused by the backup of sewers or drains, a vital coverage for homes prone to plumbing issues. Understanding these hidden home insurance coverage options can greatly enhance your home’s protection and ensure you are prepared for the unexpected.

Are You Overpaying for Home Insurance? Discover These Cost-Saving Tips

Are you wondering, Are You Overpaying for Home Insurance? Many homeowners might not realize that they could be spending more than necessary on their coverage. Factors such as inadequate comparison shopping, lack of discounts, and not understanding policy details can lead to inflated premiums. To ensure you're getting the best deal, start by gathering several quotes from different insurance providers. Utilizing online comparison tools can simplify this process and provide a clearer picture of your options.

Moreover, take advantage of cost-saving tips by reviewing your current policy for potential discounts. Many insurers offer lower rates for bundling multiple policies, maintaining a claims-free record, or installing security features in your home. Additionally, consider raising your deductible, as a higher deductible often results in lower monthly premiums. By being proactive and informed, you can significantly reduce your home insurance costs without compromising coverage.

The Truth About Home Insurance Claims: What Your Agent Won't Tell You

The truth about home insurance claims often remains shrouded in mystery, especially when it comes to what your agent may not disclose. Many homeowners believe that filing a claim is a straightforward process, but this is not always the case. While agents are there to assist you, they may not fully explain the implications of your claim on your future premiums or how it could affect your eligibility for certain coverages down the line. Understanding the fine print is crucial; for example, some policies have a deductible that can significantly impact the claim amount you receive.

Moreover, the timing of your claim can also play a critical role. Did you know that insurance companies might prioritize claims differently based on the type of damage? For instance, claims related to natural disasters could take longer to process compared to other claims. Therefore, it’s essential to document all damages thoroughly and communicate effectively with your agent. As a homeowner, ask the right questions about coverage limits and the claim process itself—what you learn might just save you from unexpected headaches when you need help the most.