CSGO Chronicles: Unfolding the Gaming Universe

Dive into the latest news, tips, and trends in the world of Counter-Strike: Global Offensive.

Drive Less, Pay Less: The Surprising Truth About Auto Insurance Discounts

Discover how driving less can slash your auto insurance costs! Uncover the hidden discounts waiting for you. Drive smart and save big!

How Driving Less Can Significantly Lower Your Auto Insurance Premiums

Reducing your time on the road can lead to significant savings on your auto insurance premiums. Insurance companies often base their rates on the risk they perceive, and driving less correlates with a lower chance of accidents. By decreasing your mileage, you may qualify for discounts as many insurers offer reduced rates for low-mileage drivers. This shift not only benefits your wallet but also contributes to a safer driving environment, thus making it a win-win situation.

To make the most of these savings, consider implementing some strategies that encourage less driving. For example:

- Utilize public transportation whenever possible.

- Carpool with friends or colleagues.

- Combine errands into fewer trips to reduce overall miles driven.

The Hidden Discounts: What Auto Insurance Companies Won't Tell You

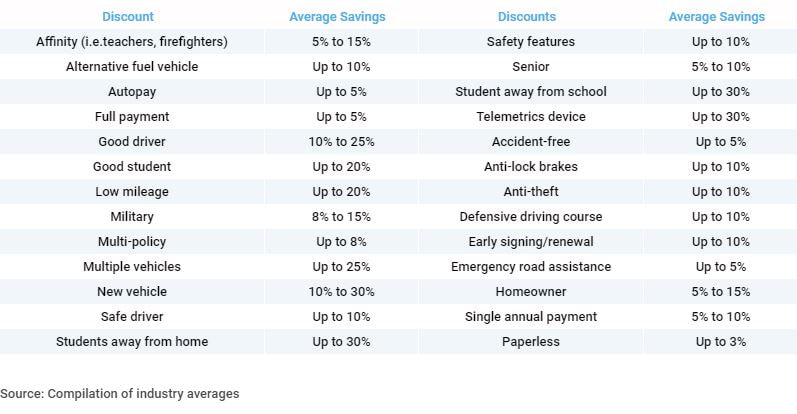

When it comes to auto insurance, many drivers are unaware of the hidden discounts that can significantly reduce their premiums. Insurance companies often keep these savings under wraps, leaving customers to pay more than necessary. For instance, did you know that simply being a good student can earn you a discount? Many insurers offer reduced rates for young drivers who maintain a certain GPA, recognizing the correlation between academic performance and responsible driving. Additionally, others offer discounts for bundling policies, such as combining auto and home insurance, which can lead to considerable savings.

Moreover, auto insurance companies frequently provide discounts for vehicle safety features that are not always advertised. If your car is equipped with advanced safety technologies like anti-lock brakes, airbags, or an anti-theft system, you may qualify for reduced rates. It's essential to inquire about these discounts when shopping for insurance. Furthermore, memberships in certain organizations or affiliations with employers can also unlock exclusive savings. By being proactive and asking questions, you can uncover these hidden discounts and ensure you're getting the most value for your auto insurance coverage.

Are You Eligible? Discover the Surprising Criteria for Auto Insurance Discounts

When it comes to auto insurance discounts, many drivers remain unaware of the various criteria that could significantly reduce their premiums. Eligibility for these discounts often extends beyond typical factors like age and driving history. In fact, insurance companies assess numerous aspects, including your driving record, the type of vehicle you drive, and even your professional background. For instance, being a member of certain organizations or holding specific professions can unlock exclusive discounts. Additionally, maintaining a clean driving record with no accidents may qualify you for safe driver discounts, making it crucial to inquire about all potential savings.

In addition to the expected criteria, many insurers offer discounts for behaviors that showcase responsibility and safety. Bundling policies, such as combining auto and home insurance, is a common way to save. Moreover, students with good grades and those who complete defensive driving courses are often rewarded with lower rates. It’s essential to approach your insurance provider and ask, “Are you running any programs or offering any discounts that I might be eligible for?” Understanding these surprising eligibility criteria can lead to significant savings on your auto insurance, helping you find the best deal while ensuring proper coverage.