CSGO Chronicles: Unfolding the Gaming Universe

Dive into the latest news, tips, and trends in the world of Counter-Strike: Global Offensive.

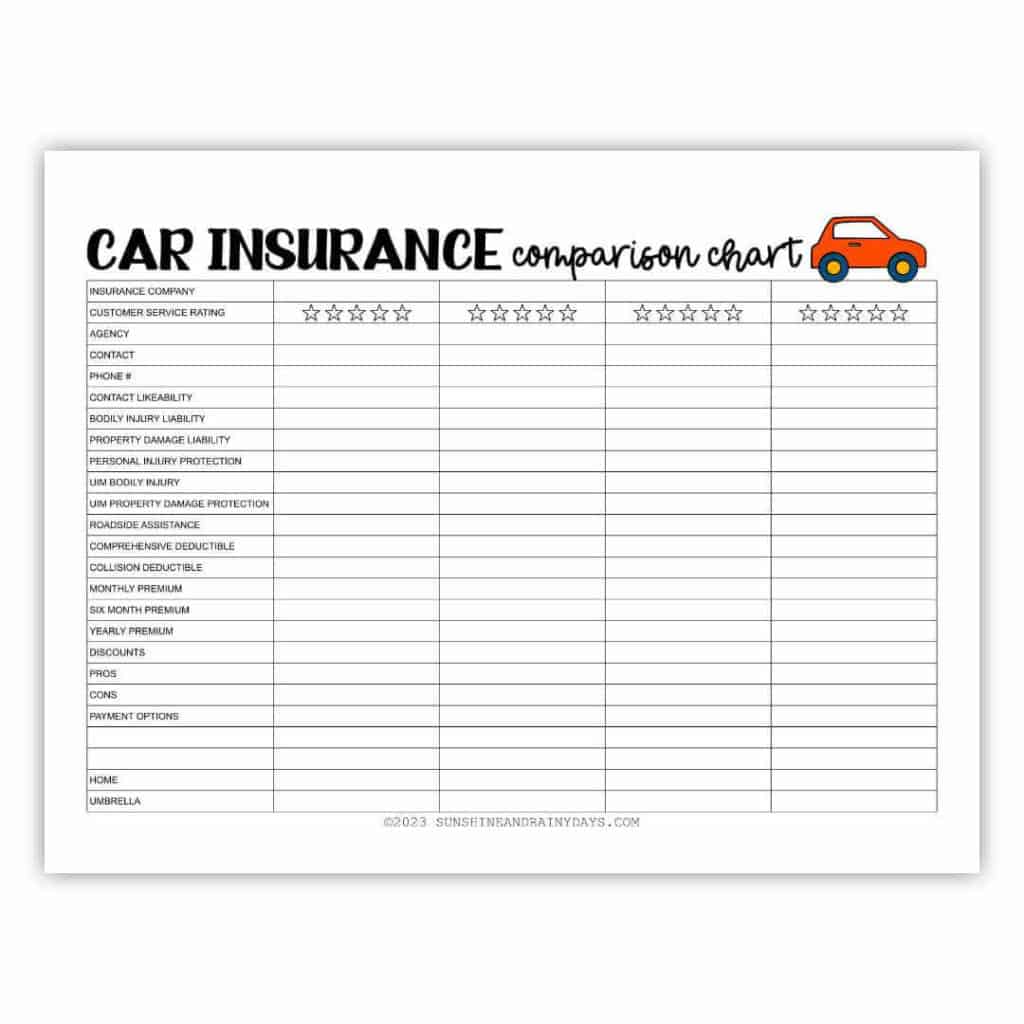

Comparison Game: Finding Your Perfect Insurance Match

Unlock the secrets to finding your ideal insurance! Dive into the comparison game and discover your perfect match today!

Understanding Different Types of Insurance: Which One Is Right for You?

Understanding different types of insurance is crucial for protecting yourself and your assets. Insurance can be broadly categorized into several types, including health insurance, auto insurance, homeowners insurance, and life insurance. Each type offers specific coverage that caters to unique needs. For example, health insurance helps cover medical expenses, while auto insurance protects you against financial loss in the event of a car accident. Knowing these distinctions will help you identify which policies are essential for your lifestyle and circumstances.

When considering which insurance coverage is right for you, it is important to assess your individual situation. Factors to consider include your health, the value of your possessions, and your financial obligations. For instance, if you have a family, life insurance may be critical to ensure their financial security in case of your untimely passing. Additionally, if you own a vehicle, having adequate auto insurance not only satisfies legal requirements but also provides peace of mind. Ultimately, the key is to evaluate your needs and choose the insurance that offers the best protection for your personal and financial well-being.

5 Key Factors to Consider When Comparing Insurance Policies

When comparing insurance policies, it is crucial to evaluate several key factors that can significantly impact your coverage and costs. One of the most important aspects is the coverage limits. These limits refer to the maximum amount an insurance company will pay for a covered loss. It's essential to ensure that the coverage limits align with your needs to avoid being underinsured. Additionally, consider the deductibles associated with each policy, as a higher deductible may lower your premium but also increase your out-of-pocket expenses when filing a claim.

Another vital factor to consider is the premium costs, as these can vary widely between different policies. Obtaining quotes from multiple insurers allows you to compare not only the premiums but also the features included in each policy. Furthermore, pay attention to the insurer's reputation and customer service. Researching reviews and ratings can provide insight into how the company handles claims and customer inquiries, ensuring you choose a reliable provider. Lastly, don't overlook any discounts or bundling options that could save you money, as these can greatly enhance your overall policy value.

How to Evaluate Insurance Quotes: A Step-by-Step Guide

Evaluating insurance quotes can be overwhelming, but breaking the process down into manageable steps can simplify it significantly. First, gather multiple quotes from different providers to ensure you have a variety of options. Compare the coverage limits, deductibles, and premiums, and take note of any urgent discounts or promotions. As you analyze the quotes, consider factors like customer service quality and the company's financial stability, which can be crucial in the event of a claim.

Next, it is essential to understand what each quote entails. Review the details carefully, paying close attention to the policy terms and any exclusions that might affect your coverage. Create a checklist of each aspect you're comparing, such as liability limits, additional features, and payment options. Once you've thoroughly examined the quotes against your needs, you can confidently select the best option that offers the most value for your insurance requirements.