CSGO Chronicles: Unfolding the Gaming Universe

Dive into the latest news, tips, and trends in the world of Counter-Strike: Global Offensive.

Compare and Conquer: Navigating the Insurance Jungle

Unravel the mysteries of insurance with our expert guide! Compare options and conquer your coverage challenges today!

Top 5 Tips for Comparing Insurance Quotes Effectively

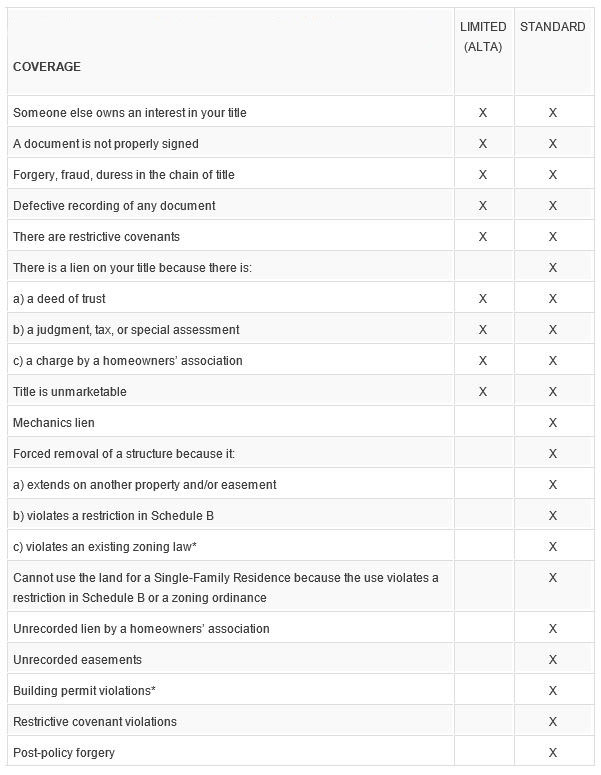

When it comes to comparing insurance quotes effectively, the first tip is to determine the specific coverage you need. Each policy can differ significantly in terms of what is covered, and knowing your requirements will help you make an informed decision. Create a checklist of critical coverage areas, such as liability, property damage, and personal injury, to ensure you are comparing apples to apples. Additionally, reach out to multiple providers for quotes to gather a wide range of options.

Next, consider the deductibles and premiums associated with each quote. A lower premium might seem attractive at first glance, but it's essential to understand how this affects your out-of-pocket expenses in the event of a claim. Always assess the balance between the premium you pay and the potential benefits you receive. You can create a simple comparison table to visualize these factors side by side, making it easier to determine which policy offers the best value for your needs.

Understanding Different Types of Insurance Policies: A Comprehensive Guide

When it comes to safeguarding your financial well-being, understanding different types of insurance policies is essential. There are several main categories of insurance, each designed to cover specific risks. These include health insurance, which helps cover medical expenses; life insurance, providing financial support to beneficiaries after the policyholder's passing; and auto insurance, required for protecting against vehicle-related mishaps. In addition to these, homeowners insurance secures your home and belongings against various threats, while liability insurance offers protection against claims resulting from injuries and damage to others.

To navigate the complexities of insurance policies effectively, it’s crucial to recognize the differences within these categories. For instance, health insurance can be broken down into various types such as HMOs (Health Maintenance Organizations) and PPOs (Preferred Provider Organizations), each offering distinct networks and cost structures. Additionally, life insurance is generally categorized into term life and whole life policies, allowing individuals to select the best option based on their long-term financial goals. Familiarizing yourself with these classifications will empower you to make informed decisions regarding your coverage needs.

Is Your Insurance Policy Right for You? Key Questions to Ask Before You Buy

Choosing the right insurance policy is crucial for protecting your assets and ensuring peace of mind. Before you make a decision, ask yourself these key questions:

- What specific coverage do I need?

- What is my budget for premiums?

- Are there any exclusions or limitations in the policy?

Another important aspect to consider is the reputation and reliability of the insurance provider. Research their customer service and claims process by reading reviews and ratings. In addition, inquire about their financial stability and history. You might also want to ask:

- How long has this insurance company been in business?

- What do current and past customers say about their experience?

- Are they licensed and in good standing with the regulatory authorities?