CSGO Chronicles: Unfolding the Gaming Universe

Dive into the latest news, tips, and trends in the world of Counter-Strike: Global Offensive.

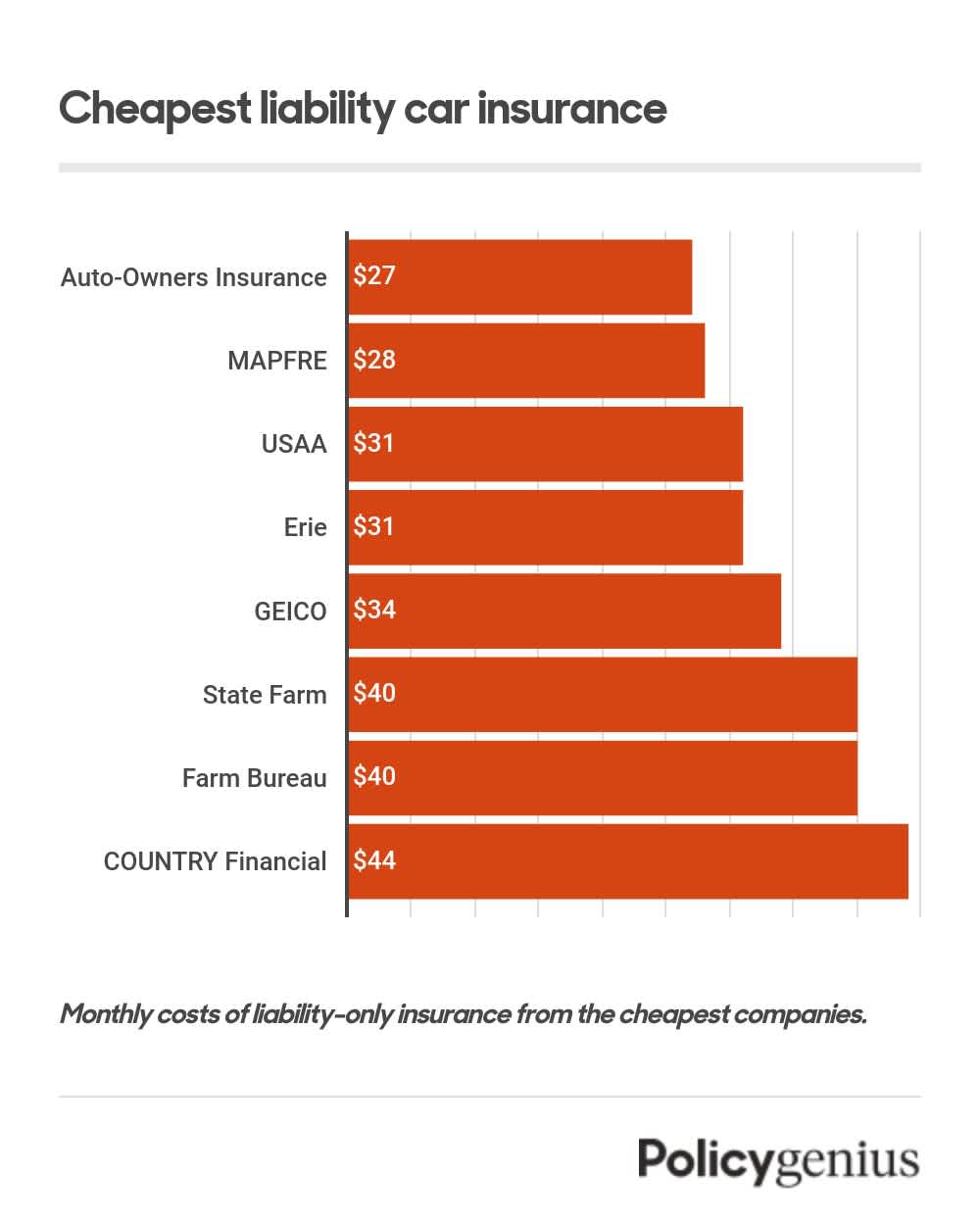

Cheap Insurance: A Wallet-Friendly Safety Net

Discover wallet-friendly insurance options that won't break the bank! Protect yourself today without overspending on coverage.

Understanding the Basics of Cheap Insurance: What You Need to Know

Understanding the basics of cheap insurance is essential for anyone looking to protect their assets without breaking the bank. Cheap insurance options are often available, but it's crucial to recognize that price does not always correlate with quality. When searching for affordable insurance, consider the type of coverage you genuinely need, such as liability, collision, or comprehensive coverage. Be sure to evaluate various providers and their policies, as rates can vary significantly based on your individual circumstances, including your location, driving record, and even credit score.

Another important aspect of cheap insurance is understanding the terms and conditions associated with the policy. Make sure to read the fine print, as some low-cost options may come with hidden fees or exclusions that can impact your coverage when you need it most. Consider asking about deductibles and how they affect your premium; higher deductibles can lower monthly payments but may lead to out-of-pocket expenses during a claim. To make informed decisions, compare multiple quotes and use online tools to conceptualize what type of coverage fits your budget while still providing the necessary protection.

Top 5 Tips for Finding Affordable Insurance Without Compromising Coverage

Finding affordable insurance while maintaining adequate coverage can be a challenge, but it's not impossible. Start by comparing quotes from multiple insurance providers. Use online tools to gather estimates and consider reaching out to agents for personalized options. This process allows you to get a clear picture of market rates and identify affordable plans that fit your needs.

Next, consider increasing your deductibles. A higher deductible typically results in lower premiums, making your insurance more affordable. However, ensure that you can comfortably pay the deductible in case of a claim. Additionally, bundle your policies whenever possible. Many insurers offer discounts for customers who combine home, auto, or other types of insurance, allowing you to save money without sacrificing coverage.

Is Cheap Insurance Right for You? Key Questions to Consider

When considering cheap insurance, it's essential to evaluate your personal needs and financial situation. Begin by asking yourself a few key questions:

- What types of coverage do I truly need?

- Am I willing to sacrifice coverage limits to save money?

- How does my claims history impact my premium rates?

Moreover, it's important to analyze the potential trade-offs associated with cheap insurance. While saving on monthly premiums may seem appealing, consider the consequences of having higher deductibles, limited coverage, or inadequate customer service. Ask yourself:

- Will I be able to afford the deductible in the event of a claim?

- How reliable is the insurance provider's customer service?