CSGO Chronicles: Unfolding the Gaming Universe

Dive into the latest news, tips, and trends in the world of Counter-Strike: Global Offensive.

Banking: The Secret Life of Your Money

Uncover the hidden world of your finances! Discover how banking shapes your money's journey in ways you never imagined.

Understanding Interest Rates: How Your Money Grows in the Bank

Understanding interest rates is crucial for anyone looking to grow their savings. When you deposit money in a bank, you're actually lending it to the bank in exchange for interest payments. These payments are typically expressed as a percentage known as the interest rate. The higher the interest rate, the more your money will grow over time. For instance, if you deposit $1,000 at an interest rate of 2% per annum, you would earn $20 in a year. Over time, thanks to the power of compounding, your earnings can accumulate significantly, making this understanding essential for maximizing your savings.

There are two primary types of interest rates that impact how money grows in the bank: simple interest and compound interest. Simple interest is calculated only on the principal amount, while compound interest considers both the principal and the accumulated interest over time. This difference can lead to substantial variations in the total return on your savings. To illustrate this, consider the following example: If you invest $1,000 at a simple interest rate of 5%, you would earn $50 annually. However, if that same amount is invested at a compound interest rate of 5%, your earnings would increase each year as you earn interest on both the initial deposit and the interest it generates.

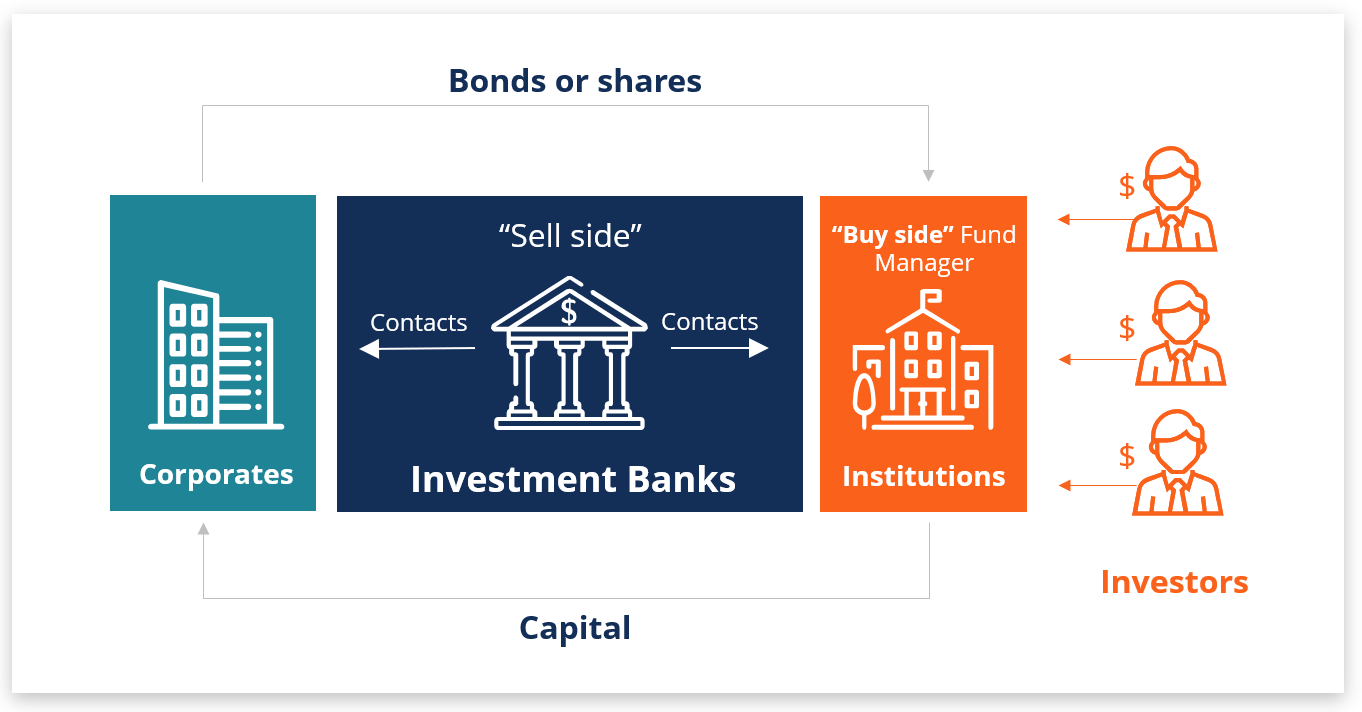

The Journey of Your Money: From Deposit to Investment

The journey of your money begins the moment you make a deposit into your bank account. This deposit is not just a simple transaction; it serves as the foundation for your financial future. Once your funds are securely in the bank, they typically enter the financial ecosystem where various institutions use your savings to generate interest. The bank pays you a small percentage, while investing that same money in loans or securities. This process highlights the importance of understanding how your deposits can work for you, amplifying their potential through different financial vehicles.

As your money grows, you may look to transition from simple savings to investments. Making this transition involves a careful evaluation of your financial goals and risk tolerance. You can consider options such as stocks, bonds, or mutual funds, each offering different levels of return and risk. It's essential to diversify your investments to create a balanced portfolio that can weather market fluctuations. Ultimately, the journey of your money is not just about accumulating wealth; it's about making informed decisions that pave the way for long-term financial security and growth.

Is Your Money Safe? Demystifying Bank Security and Insurance

When it comes to financial security, one of the most pressing questions people often have is, Is your money safe? Understanding bank security measures is essential for peace of mind. Banks implement multiple layers of security to protect your funds, including advanced encryption technology, biometric access controls, and fraud detection systems. These security measures are designed to prevent unauthorized access and ensure that your money remains secure. Moreover, financial institutions are regularly audited and required to comply with strict regulations to safeguard customer funds.

In addition to bank security, it's crucial to consider bank insurance. The Federal Deposit Insurance Corporation (FDIC) insures deposits at member banks, meaning that if your bank fails, your money is protected up to $250,000 per depositor, per insured bank. This insurance is a vital layer of protection that ensures your hard-earned money is safe even in unexpected circumstances. By understanding both the security protocols banks use and the insurance available, you can rest assured knowing that your finances are well-protected.