CSGO Chronicles: Unfolding the Gaming Universe

Dive into the latest news, tips, and trends in the world of Counter-Strike: Global Offensive.

Whole Life Insurance: The Everlasting Safety Net You Didn't Know You Needed

Discover the hidden benefits of whole life insurance and why it could be the safety net you never knew you needed! Get secure today!

Understanding Whole Life Insurance: Key Benefits You May Overlook

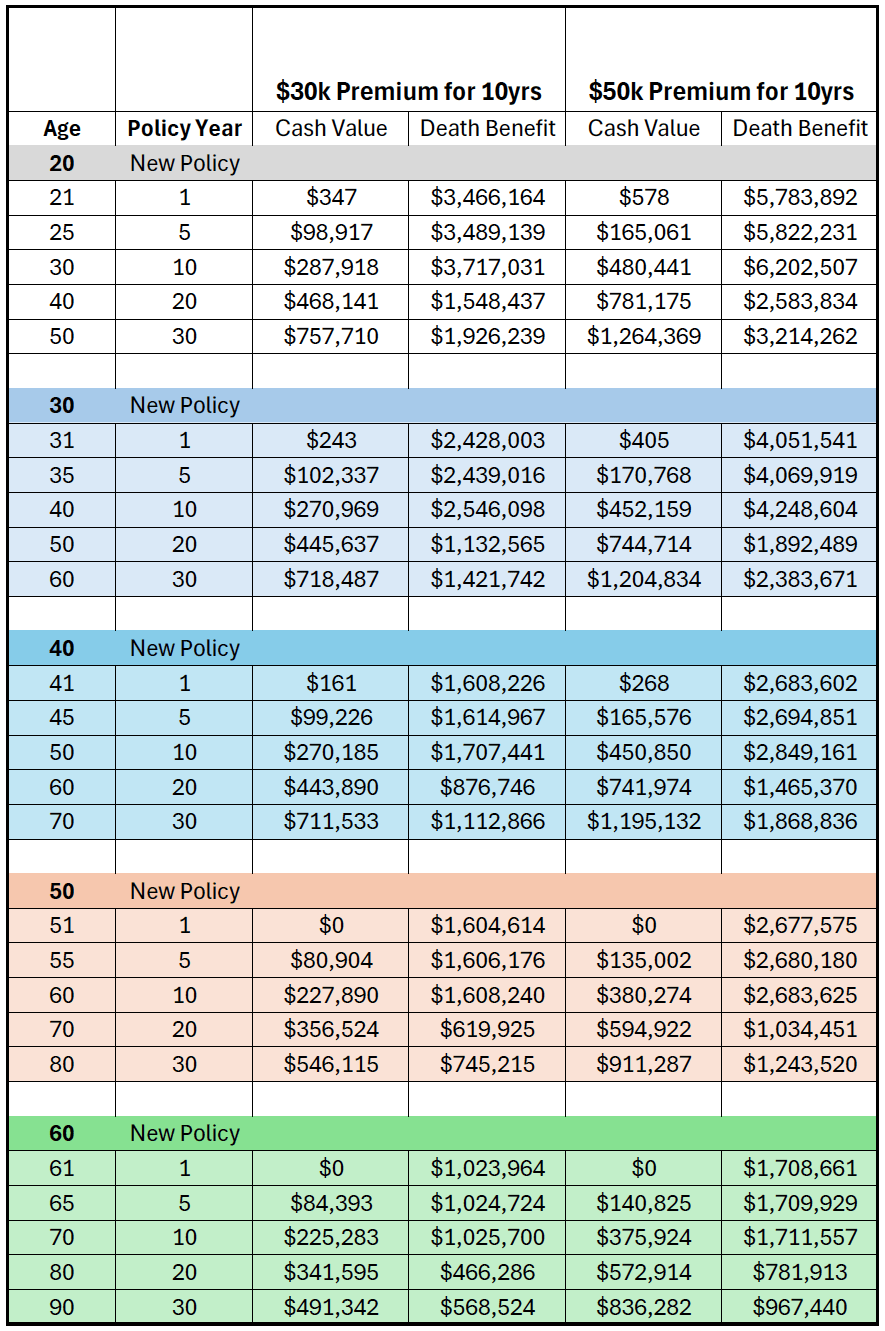

Whole life insurance is often misunderstood and typically overshadowed by term life policies. However, it offers several key benefits that many individuals may overlook when considering their insurance options. One of the primary advantages is the cash value accumulation. Unlike term insurance, a portion of your premium payments goes towards building cash value that grows over time at a guaranteed rate. This cash value can be borrowed against or even withdrawn during your lifetime, providing a financial safety net and an additional asset to tap into when needed.

Another important benefit of whole life insurance is the peace of mind it provides through its lifelong coverage. As long as premiums are paid, your policy remains in force, ensuring that your beneficiaries are protected no matter when you pass away. This creates a sense of financial security and stability for your loved ones, as they will receive a guaranteed death benefit. Moreover, the predictable premium and the potential for dividends from participating whole life policies can further enhance your financial plan, making it a wise investment for the future.

Is Whole Life Insurance Right for You? 5 Questions to Ask

When considering whether whole life insurance is right for you, it’s essential to reflect on your long-term financial goals. Whole life insurance provides lifelong coverage with a cash value component that grows over time. To determine if this type of policy aligns with your needs, ask yourself: 1. What are my financial goals? Understanding your objectives can help you evaluate if the guaranteed cash value and death benefit suit your plans.

Another critical question to ask is: 2. How much can I afford to pay in premiums? Whole life insurance typically comes with higher premiums than term life policies, meaning it’s crucial to ensure you can sustain these payments over the policy’s lifetime. Additionally, consider 3. Do I need permanent coverage? If your situation warrants long-term financial security for your beneficiaries, whole life might be the right choice. Lastly, reflect on 4. Am I willing to accept lower investment returns for guaranteed growth? and 5. How does this fit into my overall financial portfolio? These questions will guide you in making an informed decision about whether whole life insurance suits your unique circumstances.

How Whole Life Insurance Can Provide Financial Security for Generations

Whole life insurance is a powerful financial tool that not only provides coverage for the policyholder's entire life but also builds cash value over time. This cash value can be accessed during the policyholder's lifetime, offering a financial safety net for emergencies or opportunities. By investing in whole life insurance, individuals can ensure that their loved ones are taken care of, creating a legacy of financial security that can last for generations. The death benefit provided by these policies can help cover expenses such as mortgage payments, education costs, and final expenses, thereby alleviating the financial burden on family members during difficult times.

In addition to its immediate benefits, whole life insurance can serve as a long-term investment strategy. As the cash value grows, it can be used to fund important family milestones, such as weddings or college educations. Moreover, policyholders can borrow against the cash value, providing them with liquidity without sacrificing the death benefit. This makes whole life insurance not just a safety net, but also a versatile financial asset that can be passed down from one generation to the next. By choosing whole life insurance, families can cultivate multi-generational wealth and ensure that future generations have access to the financial resources they need to thrive.