CSGO Chronicles: Unfolding the Gaming Universe

Dive into the latest news, tips, and trends in the world of Counter-Strike: Global Offensive.

Why Term Life Insurance is the Unsung Hero of Financial Planning

Discover why term life insurance is the secret weapon your financial plan needs. Uncover the benefits you can't afford to ignore!

The Ultimate Guide to Term Life Insurance: Understanding Its Role in Your Financial Plan

Term life insurance is a crucial element in many individuals' financial planning, offering a straightforward solution for those seeking to protect their loved ones in the event of an unexpected tragedy. Unlike permanent life insurance, which provides coverage for the entirety of one’s life, term life insurance covers a specified period, typically ranging from 10 to 30 years. This type of policy is often more affordable and allows policyholders to allocate funds to other critical areas of their financial plan, such as savings or retirement accounts. By understanding the role of term life insurance, individuals can make informed decisions about the level of coverage needed to adequately safeguard their family’s financial future.

When considering term life insurance, it’s essential to assess your specific needs and long-term financial goals. Here are some key factors to consider:

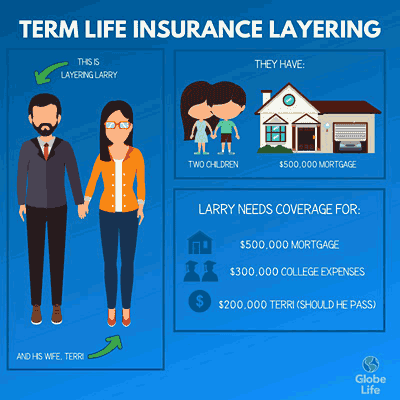

- Debt Coverage: Ensure the policy covers any outstanding debts, including mortgages and loans.

- Income Replacement: The policy should replace your income for a period long enough to support your dependents.

- Future Expenses: Consider future financial responsibilities, such as your children's education.

By addressing these elements, you can craft a comprehensive financial plan that incorporates term life insurance effectively, providing peace of mind knowing your loved ones are protected.

Top 5 Reasons Why Term Life Insurance is Essential for Family Security

Term life insurance is a crucial financial tool that provides families with peace of mind and security in uncertain times. One of the primary reasons to consider term life insurance is its affordability. Unlike whole life insurance, term policies typically offer lower premiums, allowing families to secure comprehensive coverage without breaking the bank. This affordability makes it an attractive option for young families looking to protect their loved ones while managing their budget effectively.

Another key reason why term life insurance is essential is its ability to cover significant financial obligations. In the event of a family member's untimely passing, a term life policy can provide a lump-sum payment to cover mortgage payments, children's education, and daily living expenses. This financial protection ensures that your family's standard of living is maintained and that they are not burdened with debt or financial stress during a challenging time. By investing in term life insurance, you are prioritizing your family's long-term security.

Is Term Life Insurance the Missing Piece in Your Financial Strategy?

In today's unpredictable financial landscape, many people are constantly seeking ways to safeguard their loved ones and fortify their financial stability. Term life insurance often emerges as an overlooked but crucial component of a comprehensive financial strategy. Unlike whole life policies, term life insurance provides coverage for a specified period, typically ranging from 10 to 30 years, making it an affordable option for those looking to protect their family's financial future without breaking the bank. This type of insurance can serve to cover significant expenses such as mortgages, childcare, and even education costs, allowing policyholders to have peace of mind knowing their beneficiaries will be financially secure in the event of an untimely passing.

Integrating term life insurance into your financial strategy can also serve as a strategic tool for wealth management. By reallocating saved premiums into investments, you can potentially enhance your overall financial growth while still ensuring that your family is protected. Consider a few factors when incorporating this type of insurance into your financial plan:

- The length of coverage necessary based on your current obligations.

- Your budget and how much you can allocate towards premiums.

- Regularly reviewing your life insurance needs as your financial circumstances evolve.