CSGO Chronicles: Unfolding the Gaming Universe

Dive into the latest news, tips, and trends in the world of Counter-Strike: Global Offensive.

Why Term Life Insurance is the Safety Net You Didn’t Know You Needed

Discover the unexpected power of term life insurance as your ultimate safety net—protect your loved ones and secure your peace of mind today!

The Hidden Benefits of Term Life Insurance: Protecting Your Loved Ones

Term life insurance offers not just financial protection but also peace of mind for you and your loved ones. Many people understand that it provides a payout upon the policyholder's death, but the hidden benefits go far beyond this basic function. For instance, the affordability of term policies allows families to secure substantial coverage without straining their budgets. This means that, in the event of an untimely passing, your family can maintain their lifestyle, pay off debts, and cover essential expenses. Furthermore, knowing that your family is financially secure in your absence can significantly reduce stress and anxiety, allowing you to focus on enjoying life while you can.

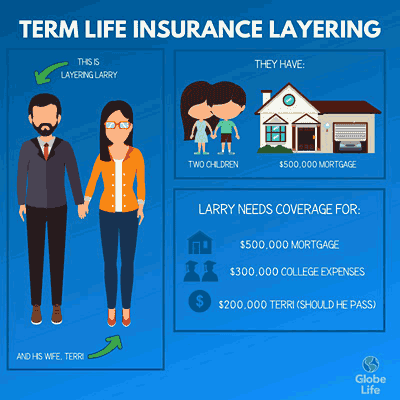

Another often-overlooked advantage of term life insurance is its versatility in financial planning. The coverage can also be utilized as a tool for setting long-term financial goals. For example, policyholders can opt for a term that coincides with crucial financial milestones, such as funding their children's education or paying off a mortgage. This strategic alignment ensures that your loved ones will not bear the financial burden during important life events. Moreover, many policies allow for conversion to permanent insurance without additional health assessments, providing a safety net that adapts to your family’s evolving needs. In essence, term life insurance not only safeguards your loved ones but also serves as a proactive step in your overall financial strategy.

Is Term Life Insurance Right for You? Understanding Your Options

When considering whether term life insurance is the right choice for you, it's important to evaluate your personal circumstances and financial goals. Term life insurance provides coverage for a specified period, typically ranging from 10 to 30 years. This type of policy is designed to offer financial protection for your loved ones in the event of your untimely death, ensuring they are not burdened with financial struggles. Factors to consider include your current debts, such as a mortgage or student loans, and your family's dependency on your income. By assessing these elements, you can determine if a term life policy aligns with your needs.

Another critical aspect to explore is the flexibility term life insurance offers compared to other insurance types. For those seeking affordable premiums, term life insurance is often more budget-friendly than permanent policies. Additionally, consider your long-term financial plans—if you're looking for coverage only during critical years when your dependents are financially reliant on you, term life may be ideal. Remember to assess your options periodically, as your situation may change, and so too may your need for insurance. In conclusion, understanding your unique situation and options is key to making an informed decision about whether term life insurance is right for you.

5 Common Misconceptions About Term Life Insurance Debunked

When it comes to term life insurance, there are several misconceptions that can lead to confusion and missed opportunities for valuable coverage. One of the most prevalent myths is that term life insurance is too expensive for the average consumer. In reality, term life policies are often more affordable than many perceive, especially when purchased at a young age. According to industry experts, the cost of term life insurance varies based on factors such as age, health, and lifestyle, making it a viable option for many individuals looking for financial protection.

Another common misconception is that term life insurance only pays out if the insured dies during the policy term. While this is technically true, many people overlook the additional benefits this type of policy can offer. For instance, some insurers provide optional riders that can enhance the policy, such as accelerated death benefits or the ability to convert to a permanent policy later. Understanding these features can help prospective policyholders maximize the value of their term life insurance and ensure they choose the right coverage for their needs.