CSGO Chronicles: Unfolding the Gaming Universe

Dive into the latest news, tips, and trends in the world of Counter-Strike: Global Offensive.

Why Renters Insurance is the Secret Ingredient to Stress-Free Living

Discover how renters insurance can transform your life! Uncover the secret to stress-free living and protect what matters most today.

The Top 5 Reasons Renters Insurance is Essential for a Worry-Free Life

Renters insurance is often overlooked by tenants, yet it plays a vital role in ensuring peace of mind. Here are the top 5 reasons why renters insurance is essential for a worry-free life:

- Protection Against Loss: Renters insurance provides financial protection against theft, fire, and other disasters that can result in the loss of your personal belongings. Without it, replacing your valuables could be a costly burden.

- Liability Coverage: Accidents happen, and if a guest is injured while visiting your home, renters insurance can cover medical expenses and legal fees, safeguarding your financial future.

In addition to protecting your belongings and providing liability coverage, renters insurance also offers additional living expenses if your rental becomes uninhabitable due to a covered incident. This means you won’t have to worry about finding a temporary place to stay or covering costs out of pocket. Additionally, many landlords mandate tenants to have renters insurance before signing a lease, making it not just a smart choice, but often a necessary one. Ultimately, investing in renters insurance translates to peace of mind and security in your living situation.

What Does Renters Insurance Cover? Debunking Common Myths

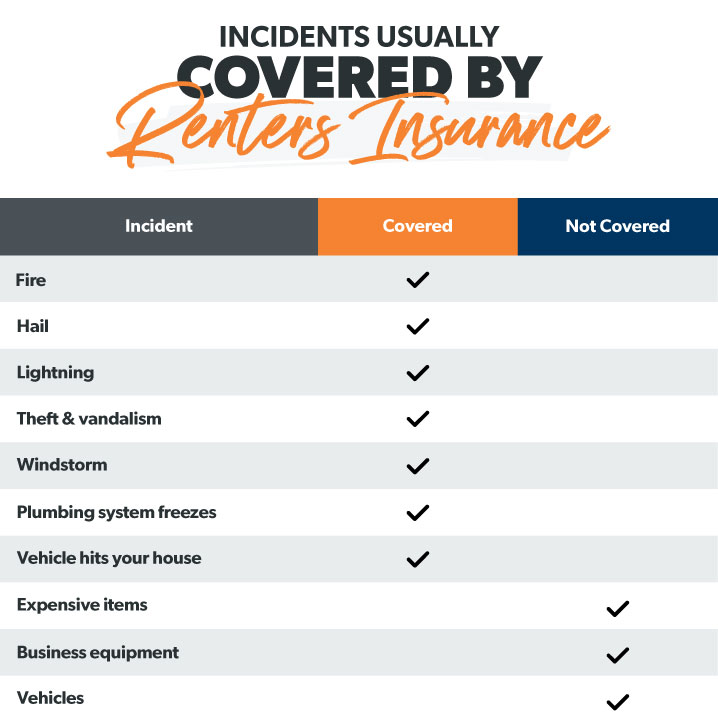

Renters insurance is often misunderstood, leading to several common myths that can deter individuals from securing this essential protection. One prevalent belief is that renters insurance only covers personal belongings. While it certainly protects your possessions, including furniture, electronics, and clothing, it also provides liability protection in case someone is injured in your rented home. This means that if a guest slips and falls, your renters insurance could help cover their medical expenses and any legal fees associated with the incident.

Another myth is that renters insurance is too expensive and not worth the cost. In reality, premiums can be quite affordable, often starting around $15 to $30 a month, depending on the coverage limits and deductibles you choose. Additionally, many renters are unaware that their policy may cover additional living expenses (ALE) if they cannot stay in their rented space due to a fire or other insured peril. This coverage can help with temporary housing and living costs, making renters insurance a smart and valuable investment for anyone renting a home.

Is Renters Insurance Worth the Investment? Here's What You Need to Know

When considering whether renters insurance is worth the investment, it's essential to weigh the potential risks and benefits. Renters insurance can provide significant financial protection by covering personal property loss or damage due to incidents such as theft, fire, or natural disasters. Additionally, it often includes liability coverage, which protects you in case someone is injured in your rented space. Without this coverage, you could face substantial out-of-pocket expenses or legal fees. In today's unpredictable environment, the cost of premiums can be a small price to pay for the peace of mind that comes with being financially protected.

However, before making a decision, it's important to analyze your circumstances. Consider factors such as the value of your belongings and the risks specific to your area. Renters insurance can be tailored to fit your needs, with various coverage options and price points available. If you live in a low-crime neighborhood or have minimal valuables, you may feel that the investment isn’t necessary. On the other hand, if you own high-value items or live in an area prone to disasters, the benefits of having coverage far outweigh the costs.