CSGO Chronicles: Unfolding the Gaming Universe

Dive into the latest news, tips, and trends in the world of Counter-Strike: Global Offensive.

Whole Life Insurance: The Safety Net You Didn't Know You Needed

Discover the hidden benefits of whole life insurance and how it can be your ultimate safety net! Secure your future today!

What is Whole Life Insurance and How Does It Work?

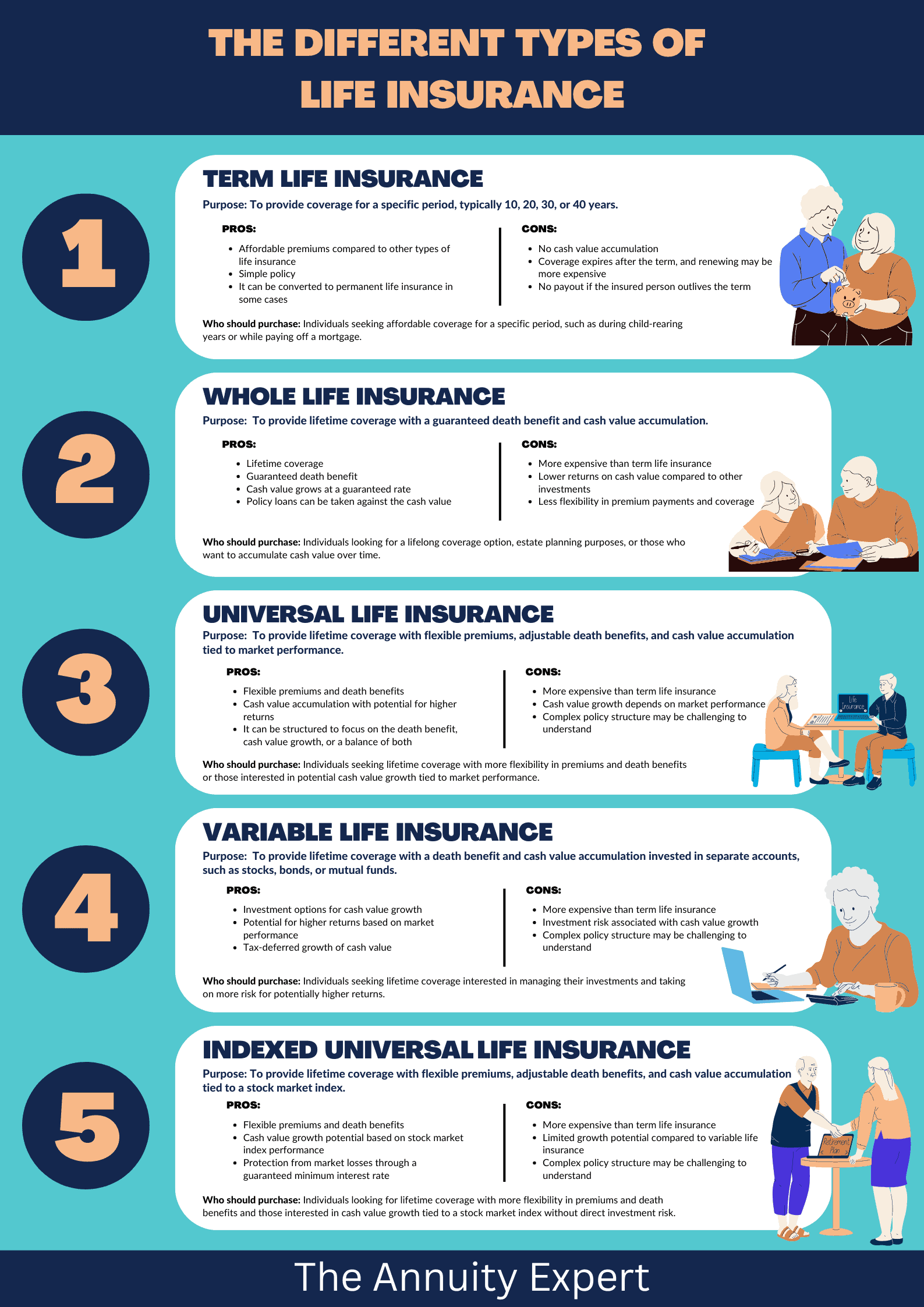

Whole Life Insurance is a type of permanent life insurance that provides coverage for the policyholder's entire life, as long as premiums are paid. Unlike term life insurance, which offers coverage for a specified period, whole life insurance combines a death benefit with a cash value component that grows over time. This cash value is accessible to the policyholder through loans or withdrawals, making it a versatile financial tool. Moreover, the premiums remain consistent throughout the life of the policy, ensuring predictability for budgeting purposes.

The way whole life insurance works is relatively straightforward. Upon the policyholder's death, the insurer pays a predetermined death benefit to the beneficiaries, providing financial security and peace of mind. Throughout the life of the policy, a portion of the premiums goes into the cash value account, which grows at a guaranteed rate. This cash value can be used to supplement retirement income, cover emergencies, or even finance major expenses. Additionally, many whole life policies offer dividends, which can be reinvested to further enhance the policy's value, adding another layer of financial benefit for policyholders.

5 Key Benefits of Whole Life Insurance You Might Overlook

Whole life insurance is often seen solely as a safety net for loved ones, but it offers numerous benefits that many people tend to overlook. One of the key advantages is the cash value accumulation. Unlike term life insurance, whole life policies build cash value over time, which can be accessed through loans or withdrawals. This feature not only provides a financial safety net but also serves as a potential resource for emergencies, education expenses, or even retirement funding.

Another significant benefit is the premium stability that whole life insurance offers. While term policies may require you to renew at potentially higher rates later in life, whole life ensures that your premiums remain constant throughout the life of the policy. This predictability allows for better financial planning and peace of mind, knowing that your coverage won't diminish as you age or your health status declines.

Is Whole Life Insurance the Ultimate Financial Safety Net for Your Family?

When considering financial protection for your family, whole life insurance often emerges as a compelling option. This type of policy not only provides a death benefit, ensuring your loved ones are financially secure in the event of your passing, but it also accumulates cash value over time. This dual benefit makes it a unique financial instrument that can serve as a foundation for long-term security. While many policies only offer temporary protection, whole life insurance stands out by providing lifelong coverage, as long as premiums are paid.

Moreover, whole life insurance can act as a savings vehicle, allowing you to borrow against the accumulated cash value for emergencies, education expenses, or other financial needs. This inherent flexibility is one of its greatest advantages, enabling policyholders to tap into their investment when necessary. Overall, by choosing whole life insurance, you are not just purchasing a policy; you are making a commitment to your family's financial future, ensuring they have a safety net that grows and adapts over time.