CSGO Chronicles: Unfolding the Gaming Universe

Dive into the latest news, tips, and trends in the world of Counter-Strike: Global Offensive.

Whole Life Insurance: The Lifelong Safety Net You Didn’t Know You Needed

Discover how whole life insurance can be your ultimate safety net and why you can't afford to miss out on this essential protection!

Understanding Whole Life Insurance: Key Benefits and Features

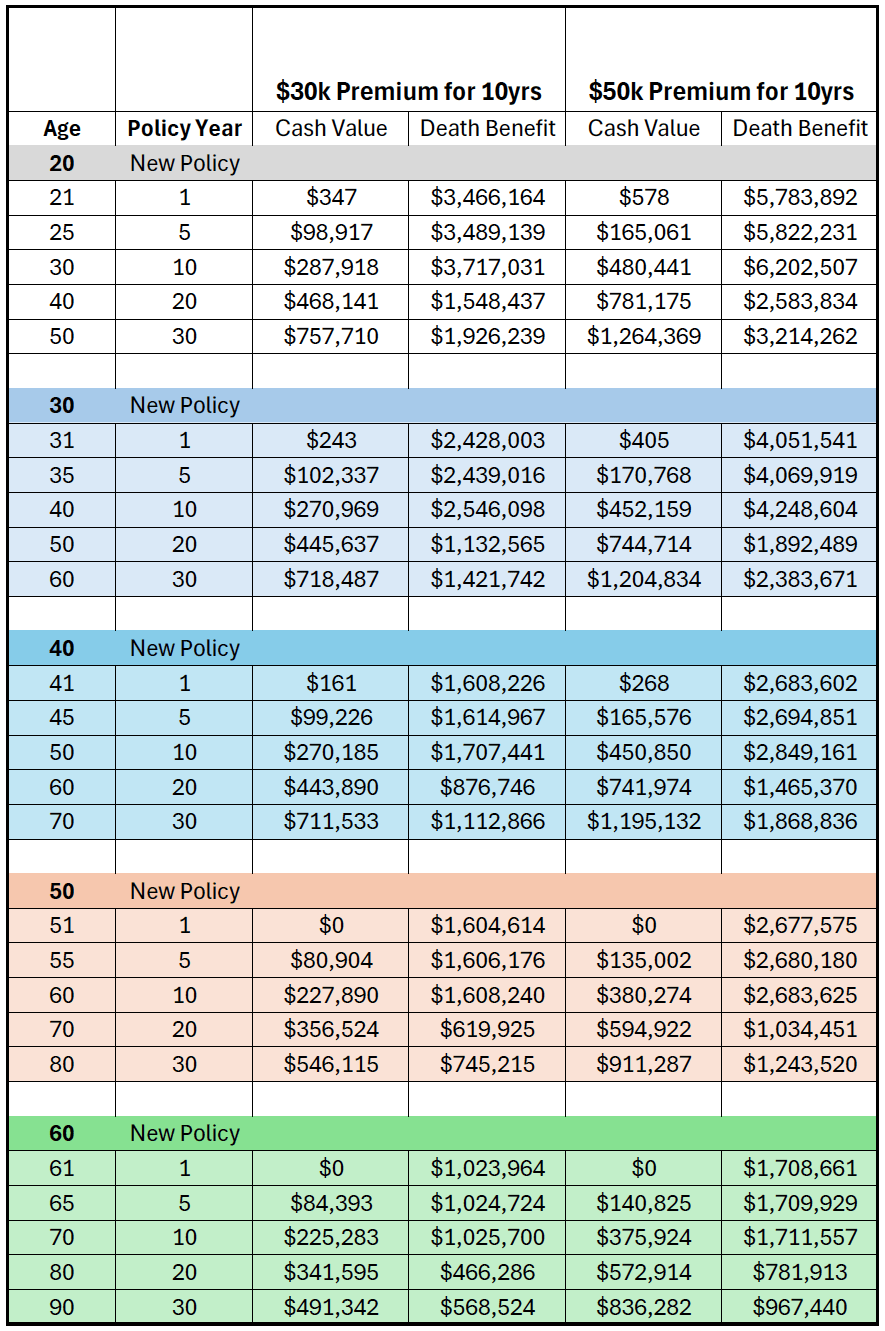

Understanding whole life insurance is crucial for anyone looking to secure their financial future. This type of permanent life insurance not only provides a death benefit to your beneficiaries but also accumulates cash value over time. The cash value grows at a guaranteed rate and can be accessed through loans or withdrawals, offering policyholders financial flexibility. Furthermore, whole life insurance premiums remain consistent throughout the policyholder's life, making it an effective long-term financial planning tool.

Among the key benefits of whole life insurance is its stability and predictability. Unlike term insurance, which expires after a certain period, whole life insurance lasts for your entire lifetime, provided premiums are paid. Additionally, it offers tax-deferred growth on the cash value, meaning you won't pay taxes on any gains until you withdraw or borrow against the policy. This feature, combined with the death benefit that provides peace of mind for loved ones, underscores why whole life insurance is a valuable asset in comprehensive financial planning.

Is Whole Life Insurance Right for You? Exploring the Pros and Cons

Deciding whether whole life insurance is right for you involves a careful consideration of its benefits and drawbacks. On the pro side, whole life insurance provides a level of predictability with fixed premiums and a guaranteed death benefit that can ensure your loved ones are financially secure after your passing. Additionally, it accumulates cash value over time, which you can borrow against or withdraw if needed. This feature adds an element of savings that can be appealing for long-term financial planning.

However, there are also significant cons to consider. One of the main drawbacks of whole life insurance is its cost; the premiums are typically much higher than those of term life insurance. This can be a financial strain for some, especially if you're looking for coverage during a stage of life when expenses are high. Furthermore, the investment aspect of whole life policies may not provide the same growth potential as other investment vehicles, leading some to question whether it's the best choice for their financial goals. Ultimately, assessing your personal financial situation and long-term objectives is crucial in determining whether whole life insurance is a suitable option for you.

How Whole Life Insurance Can Serve as a Stable Financial Foundation

Whole life insurance is often overlooked as a financial tool, yet it serves as a robust and stable financial foundation for individuals and families alike. Unlike term insurance, which provides coverage for a limited time, whole life insurance offers lifelong protection as well as a cash value component that accumulates over time. This unique feature allows policyholders to build savings while ensuring financial security for their beneficiaries. Additionally, the cash value can be accessed through loans or withdrawals, making it a flexible option during times of financial need.

Investing in whole life insurance can also provide a sense of stability in an unpredictable financial landscape. The policy's guaranteed death benefit ensures that your loved ones are protected, while the cash value grows at a guaranteed rate, providing peace of mind against market volatility. Furthermore, whole life insurance can be an effective tool for estate planning, allowing you to leave a legacy for future generations. In essence, it not only protects your family's financial future but also serves as a reliable asset that can be leveraged throughout your lifetime.