CSGO Chronicles: Unfolding the Gaming Universe

Dive into the latest news, tips, and trends in the world of Counter-Strike: Global Offensive.

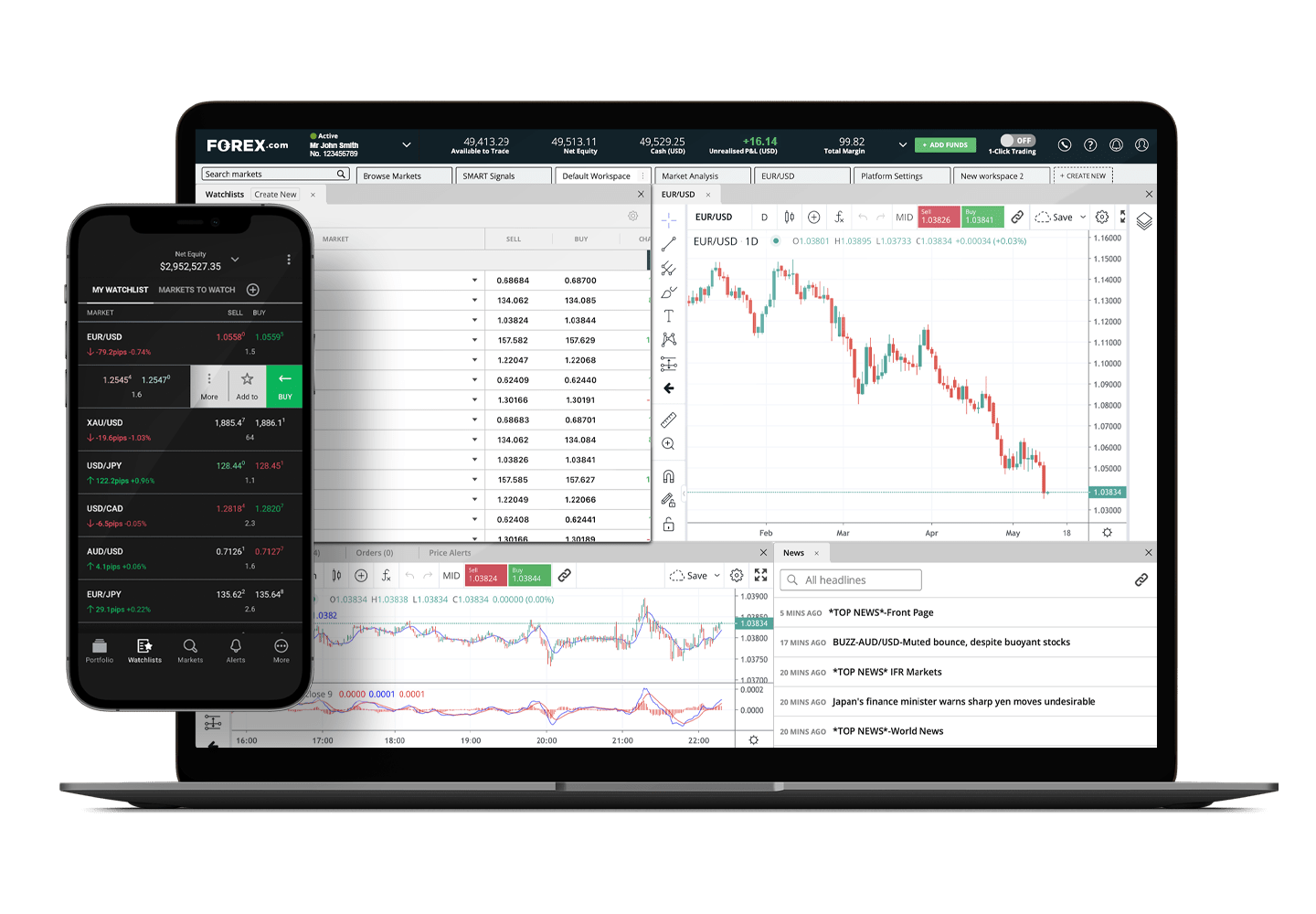

When Currency Fluctuations Become Your Best Friend

Discover how currency fluctuations can boost your finances and open new investment opportunities. Make your money work for you today!

Understanding Currency Fluctuations: How to Profit from Exchange Rate Changes

Understanding currency fluctuations is crucial for anyone looking to profit from exchange rate changes. Currency values are influenced by a variety of factors, including economic indicators, geopolitical stability, and market speculation. When traders and investors can accurately predict these fluctuations, they position themselves to gain significantly. Keeping an eye on important indicators like interest rates, inflation, and employment data can provide invaluable insights into potential currency movements.

To effectively profit from exchange rate changes, consider employing strategies such as currency trading or investing in international assets. One common approach is using the carry trade, where investors borrow in a currency with a low interest rate and invest in a currency with a higher rate, benefiting from the interest rate differential. Additionally, staying informed about global economic trends and utilizing tools like forex signals can enhance your chances of making profitable trades. By understanding these strategies, you can navigate the complexities of the forex market and capitalize on currency fluctuations.

5 Strategies to Leverage Currency Fluctuations for Your Financial Gain

Currency fluctuations can create opportunities for investors and businesses alike. To effectively leverage these changes, one of the key strategies is to diversify your investments. By spreading your investments across various currencies, you can protect yourself from the adverse effects of a single currency's depreciation. This approach not only mitigates risk but also opens up potential gains from favorable currency movements, ultimately enhancing your overall financial position.

Another effective strategy is to engage in forex trading. By speculating on currency pairs, you can capitalize on short-term fluctuations to realize immediate profits. It’s crucial to stay informed about global economic trends, political events, and interest rate changes, as these factors can substantially impact currency values. Additionally, utilizing tools like hedging can shield your investments from unexpected shifts, ensuring that you maximize your financial gain during periods of volatility.

Is Your Business Ready for Currency Fluctuations? Key Considerations and Tips

In today's global economy, businesses are constantly exposed to the risks associated with currency fluctuations. These variations can impact pricing, profitability, and overall financial health. To navigate these uncertainties, it is essential for companies to assess their readiness. Key considerations include understanding how exchange rates affect your costs and pricing strategies, analyzing your exposure to foreign currencies, and establishing a risk management plan. By being proactive, businesses can minimize the adverse effects of currency volatility and position themselves for success.

Here are some tips to help your business adapt to currency fluctuations effectively:

- Diversify your revenue streams by considering multiple currencies for sales.

- Utilize hedging strategies such as forward contracts to mitigate risks.

- Stay informed about global economic trends and exchange rates to make timely decisions.

- Consider adjustments in your pricing model to account for currency shifts.

By implementing these strategies, you can ensure that your business remains resilient and competitive, even in the face of currency volatility.