CSGO Chronicles: Unfolding the Gaming Universe

Dive into the latest news, tips, and trends in the world of Counter-Strike: Global Offensive.

Term Life Insurance: Not Just for the Overly Cautious

Discover why term life insurance is a smart choice for everyone, not just the cautious. Secure your future today!

Understanding the Benefits of Term Life Insurance for All Ages

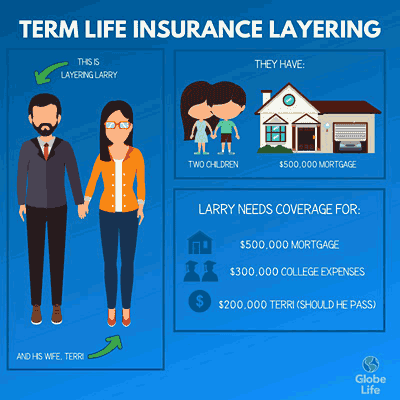

Term life insurance is a vital financial tool that provides protection for your loved ones, regardless of your age. One of its primary benefits is affordability; term life policies typically offer lower premiums compared to whole life insurance. This makes it an accessible option for individuals in their 20s and 30s who may be starting families or purchasing homes. Additionally, term life insurance offers flexibility, allowing policyholders to select coverage periods that align with their financial responsibilities, such as until children graduate college or mortgages are paid off.

Moreover, as you age, having a term life insurance policy can bring peace of mind. It ensures that in the unfortunate event of your passing, your beneficiaries will receive financial support to cover expenses like outstanding debts, daily living costs, or education expenses. This is particularly important for individuals in their 40s and 50s, who may have dependents relying on them. Overall, understanding the benefits of term life insurance is crucial for all ages, as it provides a safety net that fosters financial security and stability for families.

Is Term Life Insurance Right for You? Common Myths Debunked

Understanding term life insurance can be daunting, and with so many myths surrounding it, it's crucial to separate fact from fiction. One common misconception is that term life insurance is only beneficial for those with families. In reality, anyone with financial obligations, such as student loans or a mortgage, can significantly benefit from this coverage. It provides a financial safety net for your loved ones in the event of an untimely death, ensuring that debts can be paid off and living expenses are covered.

Another prevalent myth is that term life insurance is a waste of money because it doesn't build cash value like whole life insurance. However, this perspective overlooks the primary purpose of term life: pure protection. With term life, you pay a relatively low premium that provides substantial coverage for a set period. This can be more advantageous, especially for those who only need coverage for a specific time frame, such as while raising children or paying off a mortgage. Ultimately, determining whether term life insurance is right for you means assessing your unique needs and financial situation, helping to debunk these misconceptions.

How Term Life Insurance Can Provide Peace of Mind in Uncertain Times

In today's unpredictable world, individuals and families often find themselves grappling with various uncertainties ranging from economic fluctuations to unexpected health issues. Term life insurance provides a crucial safety net, allowing policyholders to ensure financial stability for their loved ones in the event of their untimely passing. By selecting a suitable term length, individuals can choose coverage that corresponds with key life milestones, such as paying off a mortgage or funding children's education, thereby alleviating the financial burdens that might arise in their absence.

Incorporating term life insurance into your financial planning can significantly enhance your peace of mind. Knowing that your family will be safeguarded by a death benefit during challenging times eliminates worries about their future financial responsibilities. Moreover, with options to convert to permanent policies or renew coverage as needed, term life insurance adapts to life’s evolving circumstances, further solidifying its role as an essential component of comprehensive financial security.