CSGO Chronicles: Unfolding the Gaming Universe

Dive into the latest news, tips, and trends in the world of Counter-Strike: Global Offensive.

Savvy Shoppers Score Big: The Secret World of Auto Insurance Discounts

Unlock hidden auto insurance discounts and save big! Discover savvy shopper secrets that could lower your premiums today!

Unlocking Auto Insurance Savings: What Discounts Are Available?

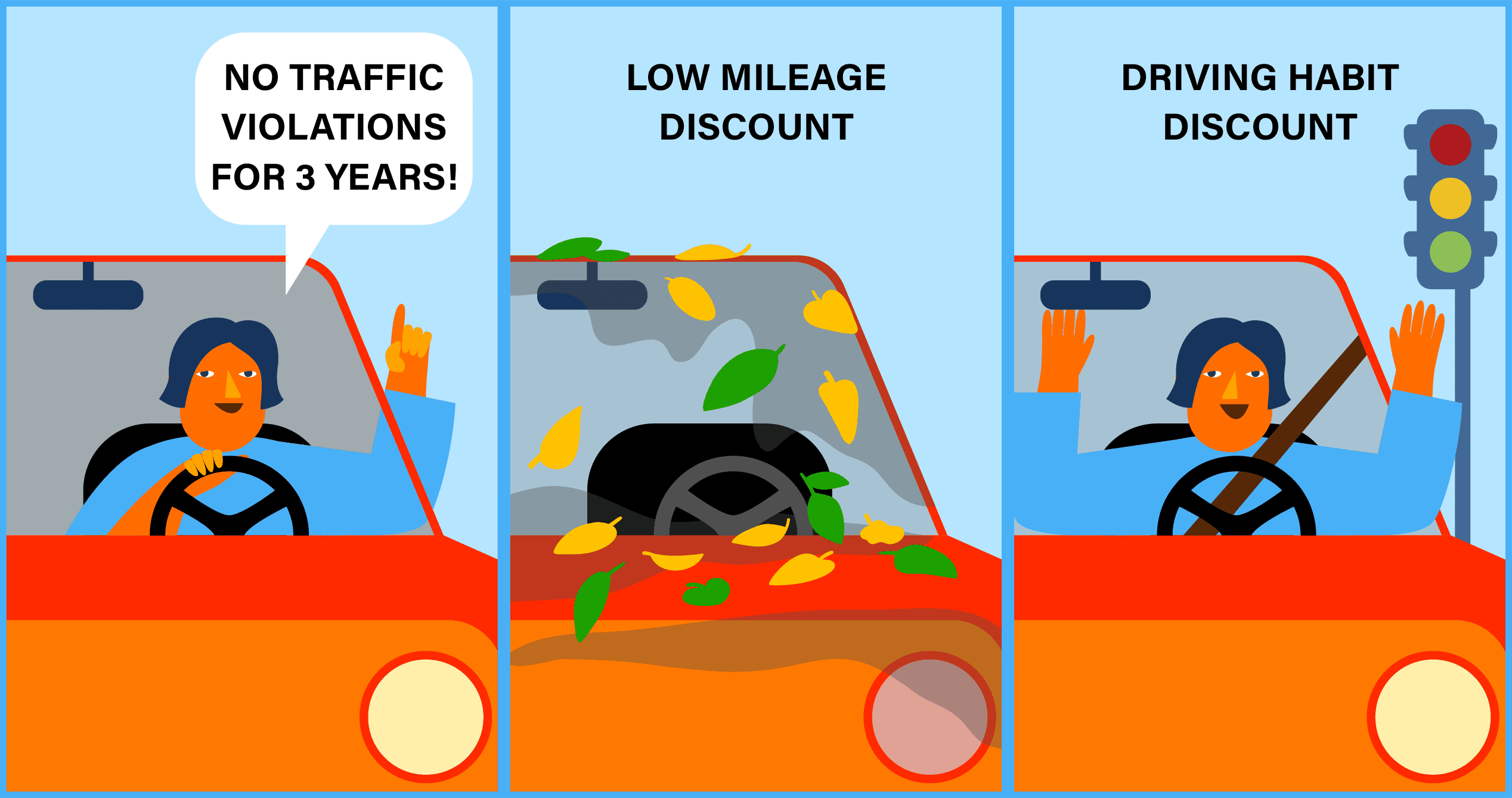

Saving on auto insurance is possible through a variety of discounts that insurers typically offer. Many companies reward safe driving habits with a safe driver discount, while bundling multiple policies (such as auto and home insurance) can yield additional savings. Furthermore, certain insurers provide discounts to members of affiliated organizations or professions—such as teachers or military personnel. It's important to check with your provider to see which discounts you may qualify for, as eligibility often varies.

In addition to the common discounts mentioned, there are several lesser-known options that can significantly reduce your premium. For instance, many insurers offer a good student discount for drivers under 25 who maintain a high GPA. Moreover, installing safety features in your vehicle, such as anti-theft devices, can also lead to lower rates. Finally, don't forget to inquire about low mileage discounts if you use your car infrequently, as less time on the road usually translates to less risk.

Maximize Your Auto Insurance Discounts: Tips and Tricks for Savvy Shoppers

When it comes to maximizing your auto insurance discounts, being a savvy shopper involves understanding the various options available to you. Start by shopping around; different insurance providers often have varying discount programs. Make sure to inquire about discounts for bundling your home and auto insurance, having a clean driving record, or being a member of certain organizations. Additionally, consider taking a defensive driving course, as many insurers offer reduced rates for drivers who complete this training.

Another effective way to secure auto insurance discounts is to regularly review your coverage. Adjusting your deductible can lead to significant savings. A higher deductible often results in lower monthly premiums, provided you can cover the out-of-pocket costs in the event of a claim. Also, don’t forget to ask your insurer about any loyalty discounts for being a long-term customer or discounts based on your vehicle’s safety features. By following these tips and tricks, you can effectively maximize your auto insurance savings.

Are You Missing Out? Common Auto Insurance Discounts You Should Know About

When it comes to auto insurance, many drivers are shocked to learn just how many discounts they may be missing out on. From bundling policies to maintaining a clean driving record, there are various ways to lower your premiums without sacrificing coverage. Here are a few common discounts to consider:

- Multi-Policy Discount: If you have other insurance policies like home or renters insurance, bundling them can lead to significant savings.

- Safe Driver Discount: Maintaining a spotless driving record can earn you discounts of up to 30%.

- Good Student Discount: Young drivers who excel academically are often rewarded with lower rates.

It’s essential to regularly review your auto insurance policy to ensure you are taking advantage of all available discounts. Some other often-overlooked options include:

- Low Mileage Discount: If you drive fewer miles than the average driver, you could qualify for reduced rates.

- Defensive Driving Course Discount: Completing a state-certified defensive driving course can not only make you a safer driver but may also qualify you for a discount.

- Military and Professional Discounts: Certain professions and military service members may receive special rates.

Don’t hesitate to ask your insurance agent about these potential savings to ensure you’re not missing out!