CSGO Chronicles: Unfolding the Gaming Universe

Dive into the latest news, tips, and trends in the world of Counter-Strike: Global Offensive.

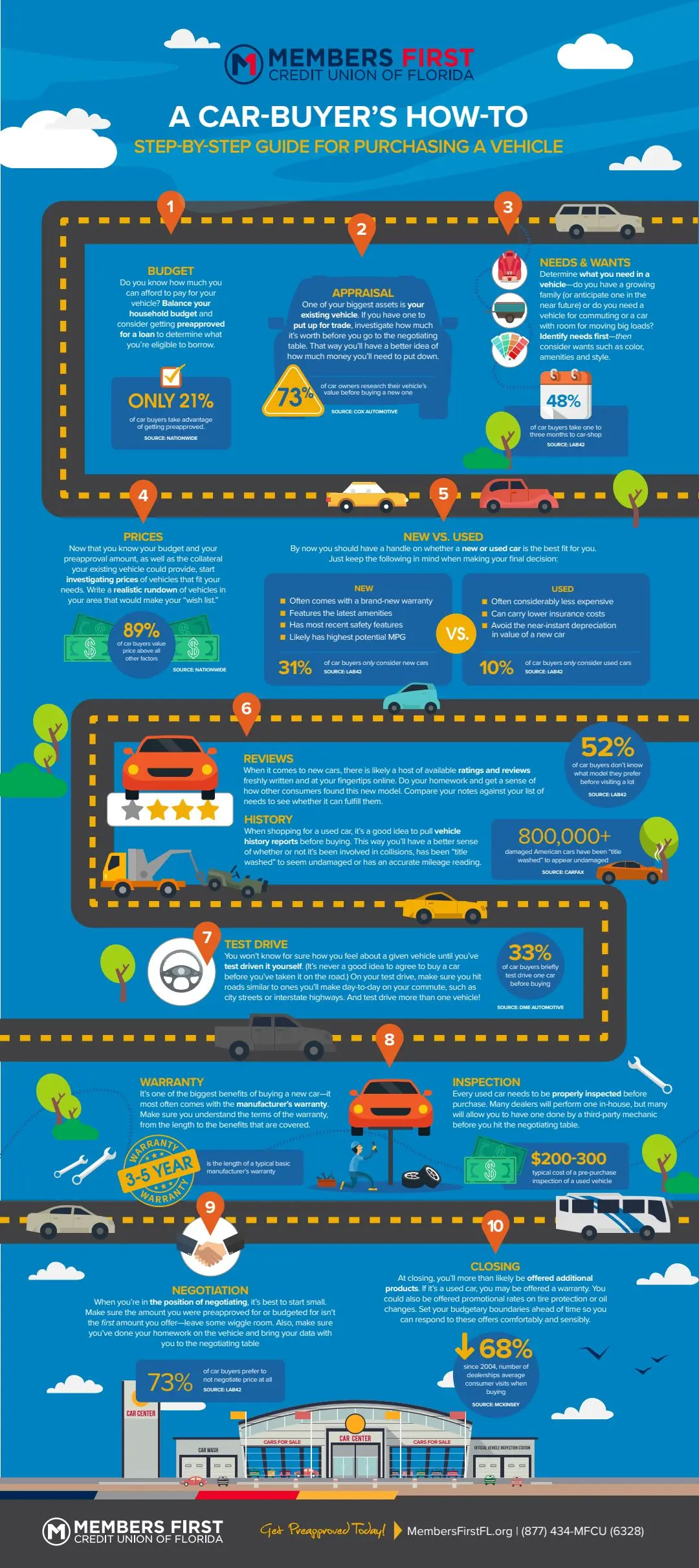

The Road to Your Dream Car: Navigate the Buying Maze

Unlock the secrets to buying your dream car! Navigate the buying maze and drive away with the perfect ride today!

Top 5 Tips for Choosing Your Dream Car Without Regret

Choosing your dream car can be a thrilling yet daunting experience. To ensure you make a decision you'll be happy with for years to come, start by establishing a budget. Analyze your finances thoroughly and consider not just the purchase price but also insurance, maintenance, and fuel costs. Having a defined budget will narrow down your options and prevent financial strain down the road.

Next, think about your lifestyle needs. Consider factors such as the number of passengers, driving conditions, and storage space. Make a list of essential features that matter most to you, whether it's a particular safety rating, fuel efficiency, or tech integration. By focusing on these priorities, you can avoid impulse buys and ensure your final choice aligns perfectly with your daily life.

Understanding the Hidden Costs of Buying a Car: What You Need to Know

When purchasing a vehicle, many buyers focus solely on the sticker price, but understanding the hidden costs of buying a car is essential for making a financially sound decision. Hidden costs can include things like taxes, registration fees, and insurance premiums, which can significantly increase the overall price you pay. According to experts, these additional expenses can potentially add thousands of dollars to your initial budget, making it critical to factor them into your calculation from the outset.

Additionally, maintenance and fuel costs are often overlooked when estimating the true cost of ownership. Routine maintenance such as oil changes, tire rotations, and unexpected repairs can add up quickly. Moreover, fuel efficiency varies widely among different models, leading to varying ongoing expenses. By considering these factors, along with financing options and resale value, you can gain a clearer picture of what it truly costs to own a car, ensuring that you make a wise and informed purchase.

Is Now the Right Time to Buy Your Dream Car? Key Factors to Consider

Deciding whether now is the right time to buy your dream car can depend on several key factors. First, consider the current market trends. With supply chain issues causing fluctuations in inventory and prices, it's vital to research the automotive market. Analyzing factors such as interest rates, unlike previous years, can help you determine if taking the plunge now is suitable for your budget. Additionally, if you have a vehicle to trade-in, a strong market may give you more leverage when negotiating your purchase.

Another crucial element to evaluate is your personal financial situation. Assess your monthly budget to see if you can comfortably afford the monthly payments, insurance, and maintenance costs associated with owning your dream car. A good rule of thumb is to allocate no more than 15% of your monthly income to car expenses. Moreover, if you already have other financial obligations, consider how a new purchase aligns with your current goals. Timing is key, and buying your dream car should feel like an exciting investment rather than a financial burden.