CSGO Chronicles: Unfolding the Gaming Universe

Dive into the latest news, tips, and trends in the world of Counter-Strike: Global Offensive.

Life Insurance: The Unsung Hero of Financial Planning

Unlock your financial future! Discover why life insurance is the hidden gem of financial planning that everyone needs.

Understanding Life Insurance: Key Benefits for Your Financial Future

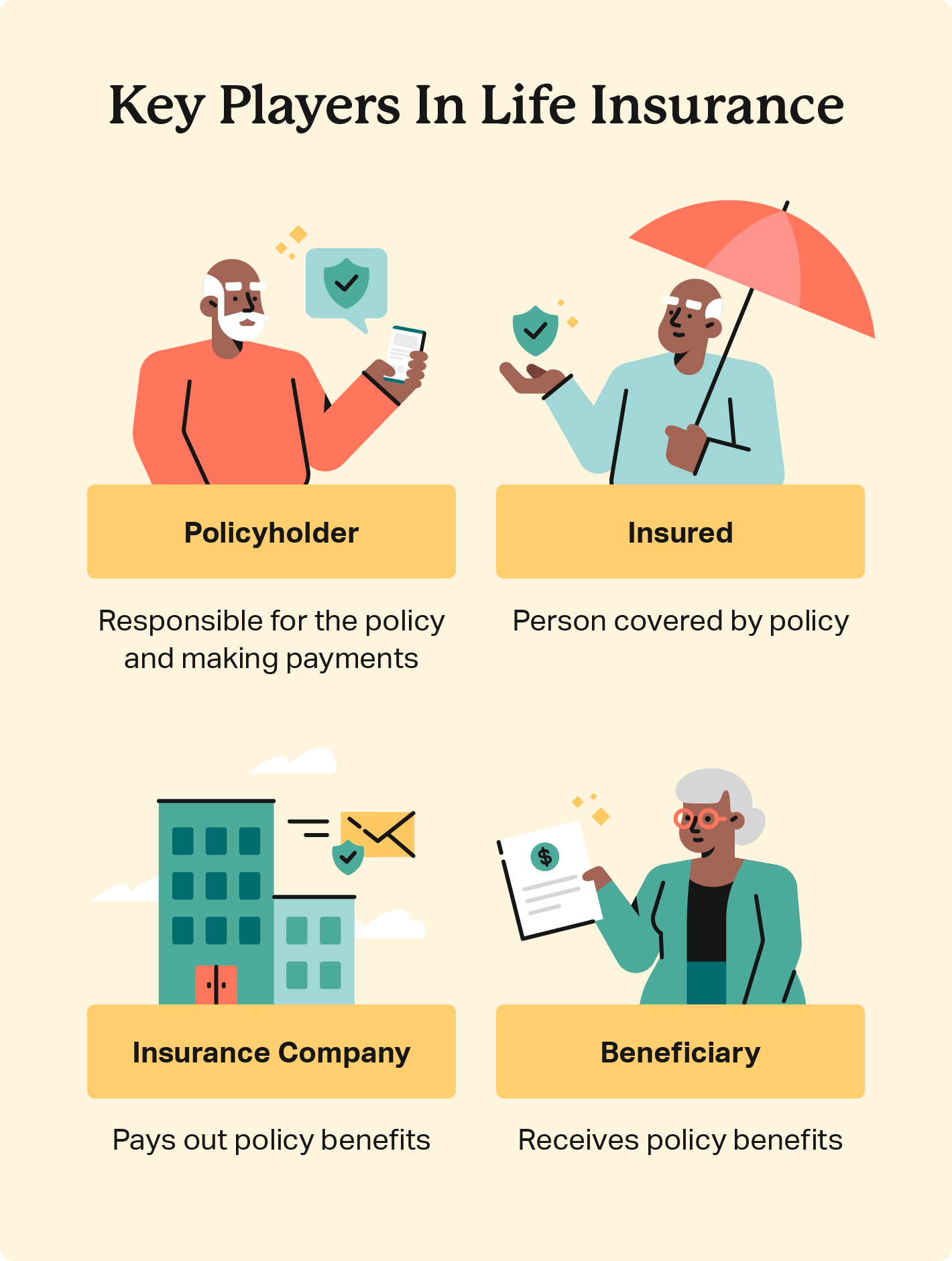

Understanding life insurance is crucial for anyone looking to secure their financial future. It serves as a safety net that not only protects your loved ones from unforeseen circumstances but also provides peace of mind. Life insurance policies can vary greatly, and it’s important to comprehend the different types available, such as term life and whole life insurance. By choosing the right policy, you can ensure that your family's needs, including daily expenses, mortgage payments, and college tuition, are covered in your absence.

The key benefits of life insurance extend beyond just death benefits. Some policies come with cash value accumulation, which allows you to build savings over time. This can serve as a financial resource for emergencies, retirement, or even as a loan collateral. Additionally, life insurance can offer tax advantages, as the payouts are generally tax-free for beneficiaries. Ultimately, investing in a life insurance policy can protect your loved ones and help you achieve long-term financial goals, making it a prudent addition to your financial planning.

Is Life Insurance Truly Necessary? Debunking Common Myths

When considering the question, Is life insurance truly necessary, it's essential to address some common myths that often cloud judgment. Many people believe that life insurance is only for the wealthy or those with dependents. This misconception can lead to significant financial risk, especially for those who may not realize that life insurance can cover debts, funeral costs, and provide for surviving family members. In reality, life insurance is a tool that can offer peace of mind, ensuring that loved ones aren't burdened with financial hardships in the event of an untimely death.

Another prevalent myth is that only older individuals need to think about life insurance. However, purchasing a policy at a younger age can be advantageous, as premiums are generally lower and health is typically better. Life insurance can also serve as an integral part of financial planning, providing cash value that can be borrowed against if necessary. Ultimately, understanding these myths helps individuals make informed decisions and recognize that having a life insurance policy can be a crucial aspect of comprehensive financial stability.

How Life Insurance Can Protect Your Family's Financial Security

Life insurance is a crucial financial tool that can provide peace of mind and protect your family's financial security in times of uncertainty. When the unexpected happens, having a life insurance policy ensures that your loved ones are not left to bear the burden of financial hardships. The benefits of life insurance can cover daily living expenses, outstanding debts, and even future goals such as education costs for your children. By prioritizing life insurance, you are making a strong commitment to safeguard your family's future stability.

One of the most significant advantages of life insurance is its ability to offer financial protection during distressing times. In the event of your passing, the death benefit paid out to your beneficiaries can serve as a financial cushion, helping them navigate through difficult situations without the added stress of financial instability. Additionally, life insurance can also play a vital role in estate planning, ensuring that your assets are distributed according to your wishes while also providing the necessary liquidity to handle potential taxes or debts. Investing in life insurance is not just about individual peace of mind; it's about securing a stable future for the ones you love.