CSGO Chronicles: Unfolding the Gaming Universe

Dive into the latest news, tips, and trends in the world of Counter-Strike: Global Offensive.

Is Term Life Insurance the Secret Sauce to Peace of Mind?

Unlock the key to peace of mind! Discover how term life insurance can be your secret weapon for financial security and family protection.

Understanding Term Life Insurance: How It Provides Peace of Mind

Term life insurance is a straightforward and affordable life insurance option designed to provide financial protection for a specified period, typically ranging from 10 to 30 years. This type of policy ensures that your loved ones receive a death benefit if you pass away within the term, offering crucial financial support during challenging times. Understanding how term life insurance works is essential for anyone looking to secure their family's future and maintain peace of mind, knowing that financial burdens will be alleviated in the event of an untimely death.

Purchasing term life insurance can lead to enhanced emotional security for both you and your family. By having a policy in place, you are effectively planning for the unexpected, which can significantly reduce stress and anxiety about your family's financial well-being. Moreover, many policies are also convertible, allowing you to switch to a permanent life insurance policy later on without undergoing further health examinations, providing additional flexibility as your needs evolve over time.

Is Term Life Insurance Right for You? Key Questions to Consider

When considering if term life insurance is right for you, it's essential to evaluate your current financial responsibilities and future goals. Ask yourself questions such as:

- What are my current debts and obligations?

- Do I have dependents who rely on my income?

- What is the duration for which I need coverage?

Another factor to consider is your budget. Term life insurance tends to be more affordable than permanent life insurance, making it an attractive option for many families. Reflect on these points:

- Can I afford the monthly premiums?

- What coverage amount is necessary to protect my family?

- Am I comfortable with the policy expiring after a certain period?

The Benefits of Term Life Insurance: A Path to Financial Security

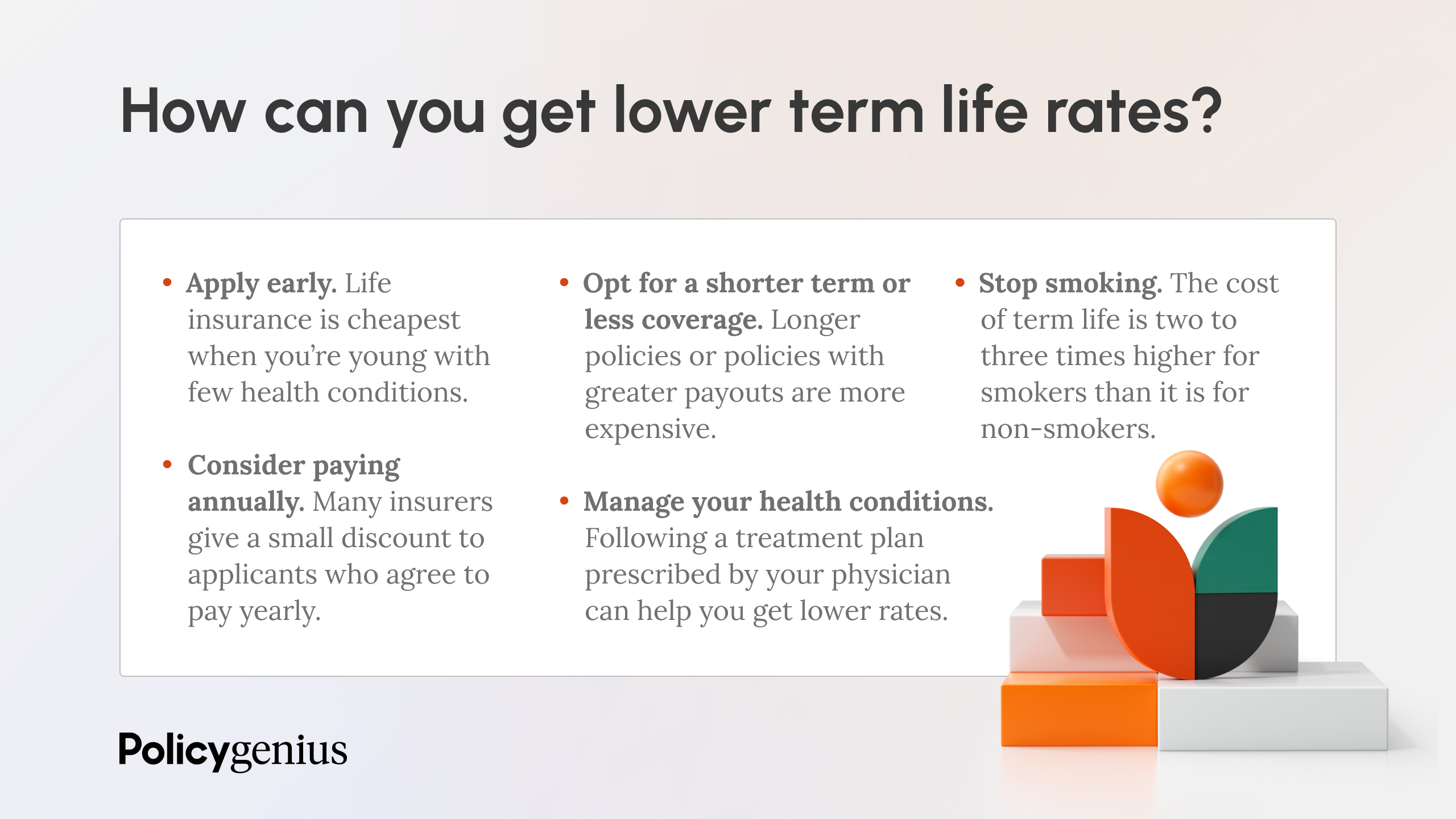

Term life insurance provides a tailored approach to financial security that can significantly ease the burden of unexpected events. One of the most compelling benefits is its affordability compared to other life insurance options. Many people find that they can secure a substantial coverage amount for a fraction of the cost, making it accessible for individuals and families alike. Moreover, term policies have a defined duration, typically ranging from 10 to 30 years, which aligns well with specific financial goals, such as paying off a mortgage or funding a child's education.

Another major advantage of term life insurance is its simplicity and ease of understanding. With straightforward terms and conditions, policyholders typically don't have to navigate complex financial jargon. This clarity extends to the claims process, which ensures that beneficiaries receive their benefits promptly when needed most. Additionally, many term life insurance policies can be converted to permanent policies later on, giving individuals flexibility in their financial planning as their needs evolve over time.