CSGO Chronicles: Unfolding the Gaming Universe

Dive into the latest news, tips, and trends in the world of Counter-Strike: Global Offensive.

How to Turn Your Wallet into a Discount Magnet with Auto Insurance

Unlock hidden savings! Discover how to transform your wallet into a discount magnet with smart auto insurance tips. Save big today!

Maximize Your Savings: Unlocking Auto Insurance Discounts You Didn't Know Existed

When it comes to auto insurance, many drivers are unaware of the numerous discounts available that can significantly reduce their premiums. Maximizing your savings starts with understanding these hidden opportunities. For instance, many insurers offer discounts for maintaining a clean driving record, bundling policies with home or rental insurance, or even for being a member of certain organizations or associations. Additionally, taking defensive driving courses or having vehicles equipped with advanced safety features can also qualify you for substantial savings.

It's also worth exploring lesser-known discounts that insurers may not advertise prominently. Some companies provide discounts for low mileage, offering financial relief to those who drive under a certain threshold each year. Others might reward long-time customers with loyalty discounts after a designated period. To truly unlock savings, it’s advisable to review your coverage regularly and discuss potential discounts with your insurance agent, ensuring that you aren’t missing out on savings that could improve your financial situation.

The Ultimate Guide to Finding Hidden Discounts in Your Auto Insurance Policy

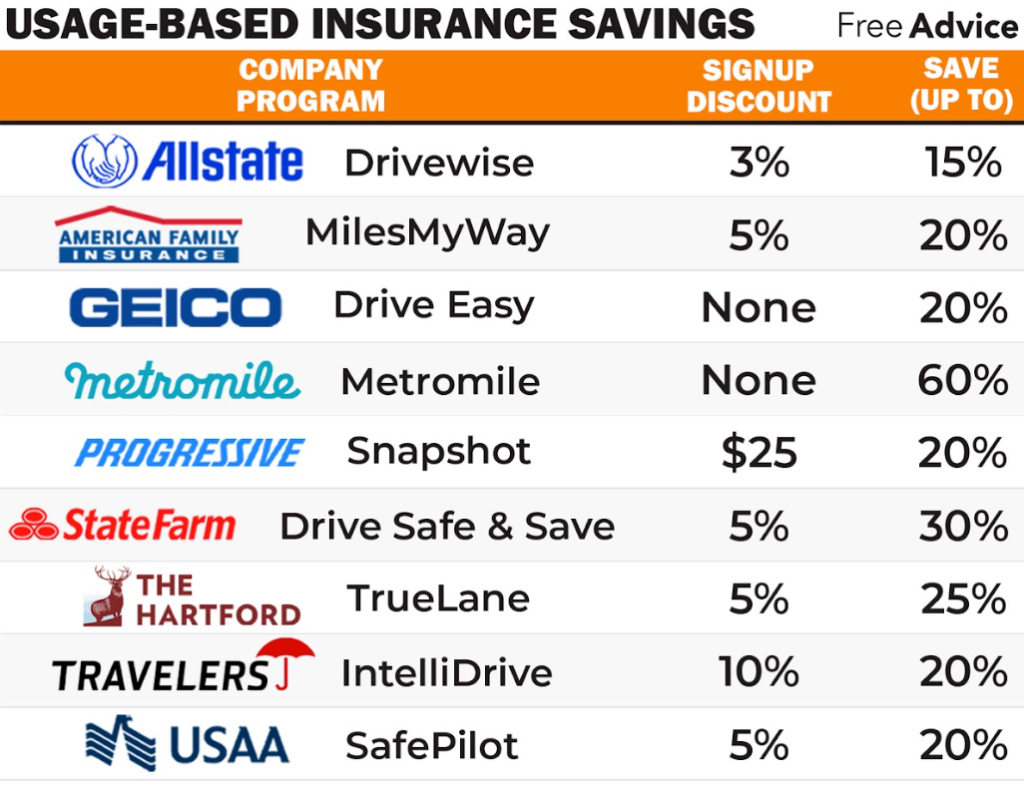

When searching for ways to save on your auto insurance, it’s essential to dig deeper than just comparing rates. Many insurance providers offer hidden discounts that are not always prominently advertised. To uncover these savings, start by reviewing your current policy closely and asking your insurer about any available discounts you may qualify for. For example, discounts can often be applied based on your vehicle’s safety features, your driving habits through telematics, or even for being a loyal customer. Don’t hesitate to utilize insurance agents as they can guide you in identifying these hidden gems.

Another effective strategy in finding hidden discounts is to consider your personal circumstances. Here are a few tips to keep in mind:

- Bundling Policies: If you have home or renters insurance, bundling these with your auto policy can lead to significant savings.

- Good Student Discounts: If you or a family member is a student maintaining a high GPA, many insurers offer good student discounts.

- Mileage Discounts: Driving less than a certain mileage threshold can qualify you for additional savings.

By being proactive and exploring these avenues, you can maximize your savings and ensure you're not leaving any money on the table.

Are You Overpaying for Auto Insurance? Discover How to Turn Your Wallet into a Discount Magnet

Are you overpaying for auto insurance? Many drivers underestimate the costs associated with their policies, often believing they are getting a good deal. However, the reality is that numerous factors contribute to the final premium you pay, from your driving history to the type of vehicle you own. To ensure you're not throwing your hard-earned money away, it’s vital to review your current policy and compare it with others on the market. Utilize online comparison tools and get quotes from multiple providers to gauge if your coverage aligns with your budget and needs.

Once you’ve assessed your options, consider implementing a few strategies to turn your wallet into a discount magnet. For instance, bundling your auto insurance with other policies, like home insurance, can often lead to substantial savings. Additionally, maintaining a good driving record, opting for a vehicle with safety features, and taking advantage of available discounts can significantly reduce your premium. Finally, don’t hesitate to reach out to your insurer and inquire about any loyal customer discounts or potential rate reductions; you might be surprised at the savings lurking just beneath the surface.