CSGO Chronicles: Unfolding the Gaming Universe

Dive into the latest news, tips, and trends in the world of Counter-Strike: Global Offensive.

Home Insurance: What Your Policy Won't Tell You

Unlock the secrets of home insurance! Discover hidden truths your policy won't reveal and save money while protecting your home.

10 Hidden Exclusions in Your Home Insurance Policy

Understanding your home insurance policy is crucial, but many homeowners overlook the hidden exclusions that can leave them unprotected. Here are 10 hidden exclusions that you may encounter:

- Flood damage

- Earthquake damage

- Maintenance issues

- Pest infestations

- Wear and tear

- Intentional damage

- Negligence

- Home-based businesses

- Luxury items

- Structural changes

By familiarizing yourself with these exclusions, you can better prepare for potential risks and ensure that your home is adequately protected. Always consult your policy and ask your insurer for clarification on any terms you don’t understand.

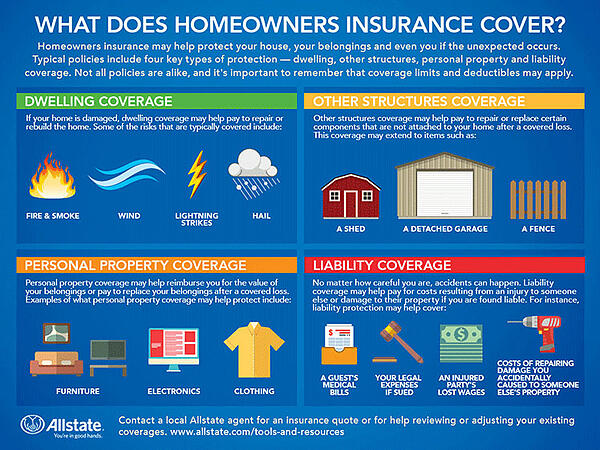

The Importance of Understanding Your Home Insurance Coverage

Understanding your home insurance coverage is essential for protecting your most valuable asset: your home. Many homeowners mistakenly believe that their policy covers everything, but this is not always the case. It’s crucial to review the specifics of your coverage to identify what is included and what is excluded. Key components typically include dwelling protection, which covers the structure of your home, personal property protection, which covers your belongings, and liability protection, which protects you against lawsuits. By knowing these facets, you can better tailor your insurance policy to suit your needs and avoid unexpected costs during a claim.

Moreover, having a comprehensive understanding of your home insurance coverage allows you to make informed decisions. For instance, if you live in an area prone to natural disasters, you might need to consider additional endorsements, such as flood or earthquake insurance, which are often not included in standard policies. Additionally, being aware of policy limits and deductibles can be pivotal in ensuring you have adequate protection without overpaying for your premiums. In short, taking the time to thoroughly grasp your coverage not only safeguards your property but also provides you with peace of mind, knowing you are better prepared for unforeseen events.

What Home Insurance Companies Don’t Want You to Know

What Home Insurance Companies Don’t Want You to Know is a crucial question for homeowners seeking to protect their investments. Many people assume that all policies are created equal, but the reality is that home insurance companies often hide certain details that can significantly impact your coverage. For example, deductibles may vary widely between plans, and some companies may offer lower premiums by increasing these deductibles without your knowledge. It's essential to read the fine print and ask specific questions about what is covered and what isn't, to unveil potential loopholes that could cost you dearly in the event of a claim.

Additionally, home insurance companies often use complex algorithms and risk assessment tools that determine your premium rates, but they may not disclose all the factors at play. Factors such as credit score, the age of your home, and even your location can influence your rates more than you realize. This lack of transparency can lead to frustration if you face sudden premium hikes after years of consistent payments. To counter this, always compare quotes and policies from multiple providers to ensure you receive the best coverage for your money while being fully aware of the stipulations behind your insurance contract.