CSGO Chronicles: Unfolding the Gaming Universe

Dive into the latest news, tips, and trends in the world of Counter-Strike: Global Offensive.

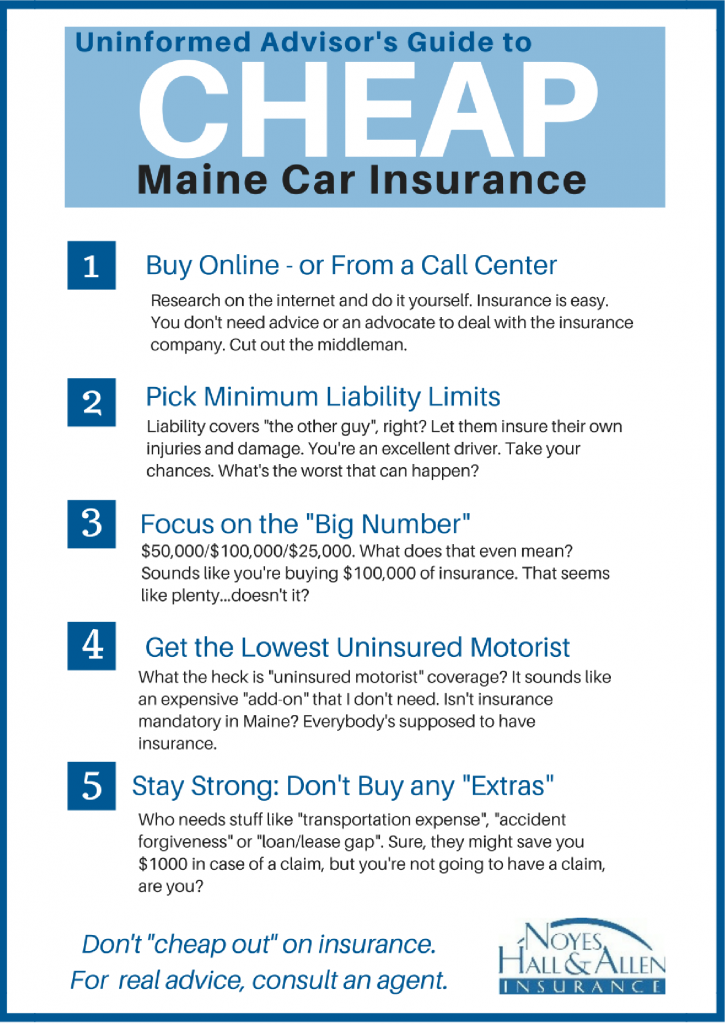

Cheap Insurance: A Wallet-Friendly Safety Net

Discover wallet-friendly insurance options that protect your future without breaking the bank. Save money and stay secure today!

5 Tips for Finding Affordable Insurance Without Sacrificing Coverage

Finding affordable insurance while maintaining adequate coverage can be a daunting task. However, by following a few strategic tips, you can ensure that you don't compromise on the quality of your coverage. Start by comparing policies from different insurers. Use online comparison tools to see what each company offers and read reviews to understand the experiences of other customers. Consider not only the premium costs but also the coverage limits and exclusions.

Another effective strategy is to bundle your insurance policies. Many companies offer discounts if you purchase multiple types of insurance, such as home and auto, from them. Additionally, don't hesitate to ask about discounts for safe driving, good credit, or even membership in certain organizations. Remember, taking the time to reassess your coverage regularly is key. Life changes, and so do your insurance needs, so reviewing your policy annually can help you find better deals without sacrificing coverage.

Is Cheap Insurance Worth It? Understanding the Trade-offs

When considering whether cheap insurance is worth it, it's essential to evaluate the trade-offs involved. On one hand, a lower premium can free up your budget, allowing for other financial priorities. However, cheaper policies often come with reduced coverage, higher deductibles, and limited customer service options. For instance, if an unexpected event occurs, you may find yourself underinsured, leading to significant out-of-pocket expenses. Thus, while the initial cost may seem appealing, the long-term implications on your financial security must be carefully considered.

Furthermore, understanding the specifics of cheap insurance policies can shed light on their potential drawbacks. Many affordable plans may lack key features such as comprehensive coverage for natural disasters or necessary liability limits. To illustrate, let’s consider the following trade-offs:

- Coverage Limitations: Cheaper policies may not cover all assets, leaving gaps in protection.

- Claims Process: Cheaper insurers might have a more cumbersome claims process, delaying your access to funds.

- Customer Service: Lower premiums often entail less robust customer support when you need assistance.

What to Look For When Comparing Budget-Friendly Insurance Policies

When comparing budget-friendly insurance policies, it’s essential to evaluate the coverage offered by each option. Start by identifying your specific needs, whether it's health, auto, or home insurance. Look for policies that provide adequate coverage limits for important areas such as liability and personal property. Additionally, consider any deductibles that come with the policy; a higher deductible might lower your premium, but it could also lead to out-of-pocket expenses at the time of a claim. Don't forget to read customer reviews and testimonials to get a sense of the company’s reputation.

Another crucial aspect to assess is the premium costs in relation to the benefits provided. Create a comparison list that includes each policy's monthly or annual premium, the coverage details, and any applicable discounts. It’s also wise to inquire about potential increases in premiums over time and the conditions under which they may rise. Finally, review the policy’s exclusions to ensure you understand what isn’t covered, as this can significantly affect your overall satisfaction with the policy and your financial protection in the future.