CSGO Chronicles: Unfolding the Gaming Universe

Dive into the latest news, tips, and trends in the world of Counter-Strike: Global Offensive.

Banking on Fun: Why Your Money Deserves a Personality

Unlock the secrets of joyful finances! Discover why adding personality to your money can lead to a happier, wealthier life.

5 Ways to Inject Personality into Your Finances

Injecting personality into your finances doesn't mean abandoning smart money management. Instead, it means finding ways to make your financial journey more enjoyable and relatable. One effective method is to create a financial vision board. Gather images, quotes, and symbols that resonate with your financial goals and values. This visual representation will not only keep you motivated but will also serve as a constant reminder of why you are committed to your financial plan.

Another way to add a personal touch to your finances is by developing a budget that reflects your unique lifestyle and interests. Instead of a generic budget template, consider categorizing your expenses in a way that aligns with your passions. For instance, if you love traveling, create a category specifically for travel expenses, and set aside a portion of your income for future adventures. This approach makes budgeting feel less restrictive and more empowering, ultimately helping you stay on track while enjoying the things you love.

Is Your Money Boring? Discover the Fun Side of Banking

Are you tired of hearing money referred to as boring? It doesn’t have to be! Discovering the fun side of banking can transform the way you perceive and interact with your finances. For instance, consider turning saving into a game: gamify your savings goals by setting up challenges for yourself. You can create rewards for reaching certain milestones, such as treating yourself to a night out or a new outfit! Implementing these playful elements can turn your path to financial freedom into an exciting journey.

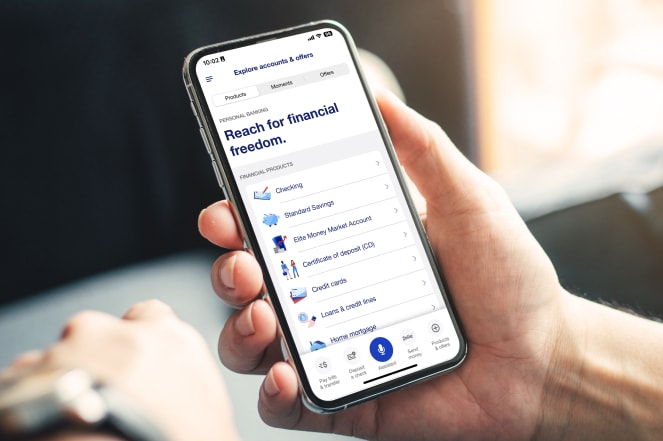

Moreover, there are innovative banking apps that make managing your money visually engaging and interactive. Many of these applications allow you to track your spending habits with colorful charts and fun notifications. Additionally, they often provide financial literacy quizzes and challenges that can deepen your understanding of personal finance while keeping the experience entertaining. By exploring these tools, you’ll find that banking is not just about numbers; it can also be about creativity, strategy, and even a little competition!

How to Create a Financial Strategy That Reflects Your Unique Personality

Creating a financial strategy that reflects your unique personality is essential for achieving long-term financial success. Start by assessing your values and priorities, as these will guide your financial decisions. Ask yourself what truly matters to you—whether it's travel, saving for retirement, or investing in personal development. Once you have a clear understanding of your values, you can begin to structure your finances accordingly. Consider utilizing tools like budgeting apps or spreadsheets to track your spending habits and ensure they align with your personal goals.

Next, customize your investment approach to match your risk tolerance and lifestyle. If you're a naturally cautious individual, you might prioritize safer investments and focus on building a solid emergency fund before venturing into the stock market. On the other hand, if you're more adventurous, you may feel comfortable exploring higher-risk investments that have the potential for greater returns. It's important to regularly revisit and adjust your financial strategy as your circumstances and personality evolve, ensuring it continues to resonate with who you are.